1) Forecast

2) Hibernating Bitcoin

3) In It Together

4) New At DAIM

-

On the crypto side, the Ethereum merge has come and gone, and network usage has not increased. Don’t expect that the change to Proof of Stake will automatically translate to increased usage and an elevated price. While new ETH issuance is now down drastically due to the mechanics of Proof of Stake, supposed supply constraint won’t have a meaningful effect on the price until demand picks up. If demand goes down the supply could increase. Either side of the demand pull could take a while to play out.

-

For the time being, we’re sticking with our 20-30k range for Bitcoin with a possible visit down to $15k. This is a great time to accumulate Bitcoin. If you loved Bitcoin at $60K you should love it at $20K. Don’t over think things here.

-

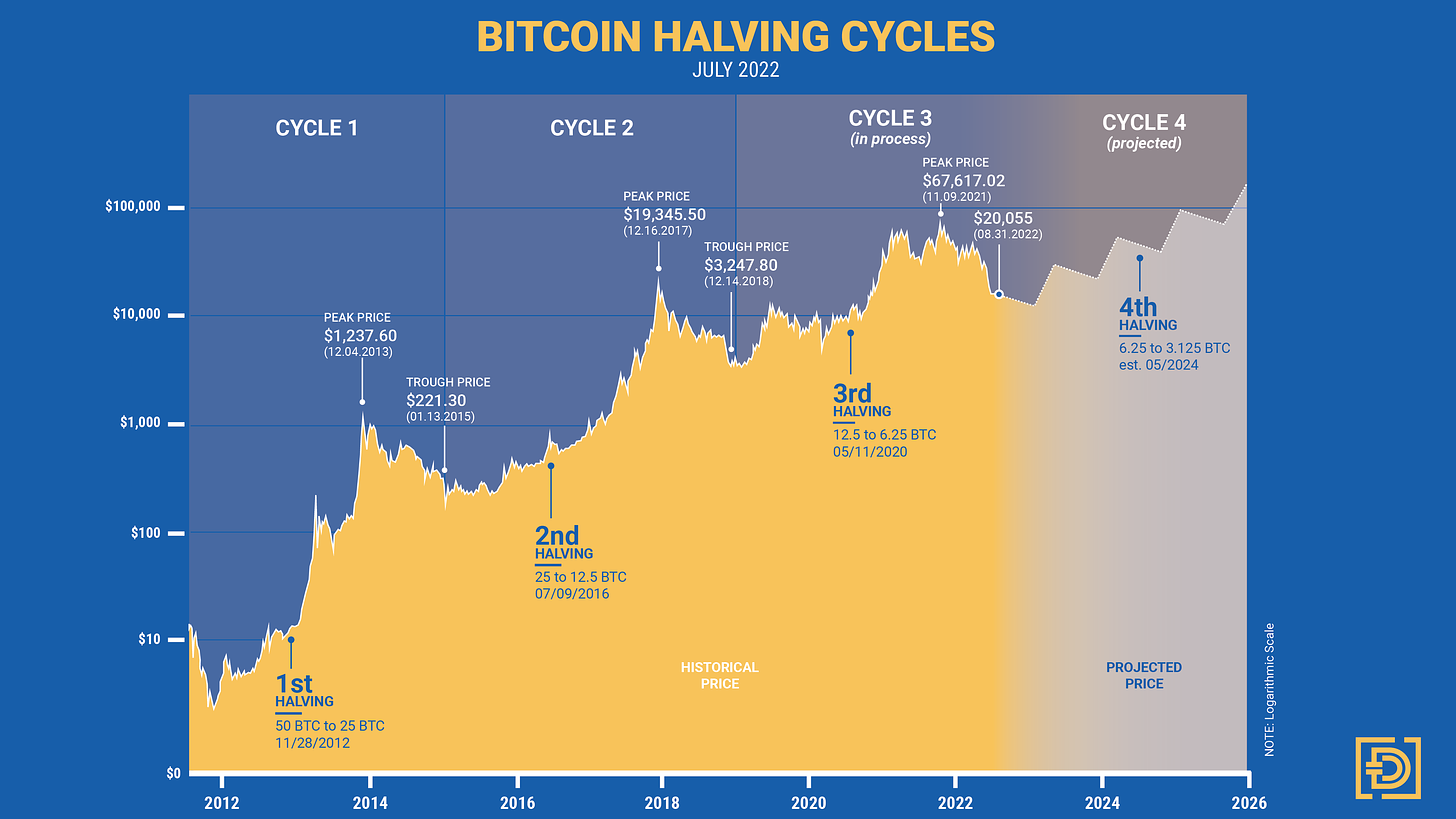

Halvings refer to Bitcoin’s block reward that goes to the successful miner that is the first to validate a block. The first block reward was 50 BTC and the reward gets cut in half about every 4 years, hence the term “halving”. The current reward is 6.25 units and in 2024 the reward will be halved again down to 3.125. From the chart you can see cycle peaks tend to happen closer to the preceding halving than the succeeding one. With increased adoption we see demand intuitively rising and the halvings continuing to be meaningful catalysts by constraining supply. When the reward halves, there is less newly mined Bitcoin that could be sold thus intuitively creating a constraint on supply. As buyer demand increases, price movements can be dramatic.

-

-

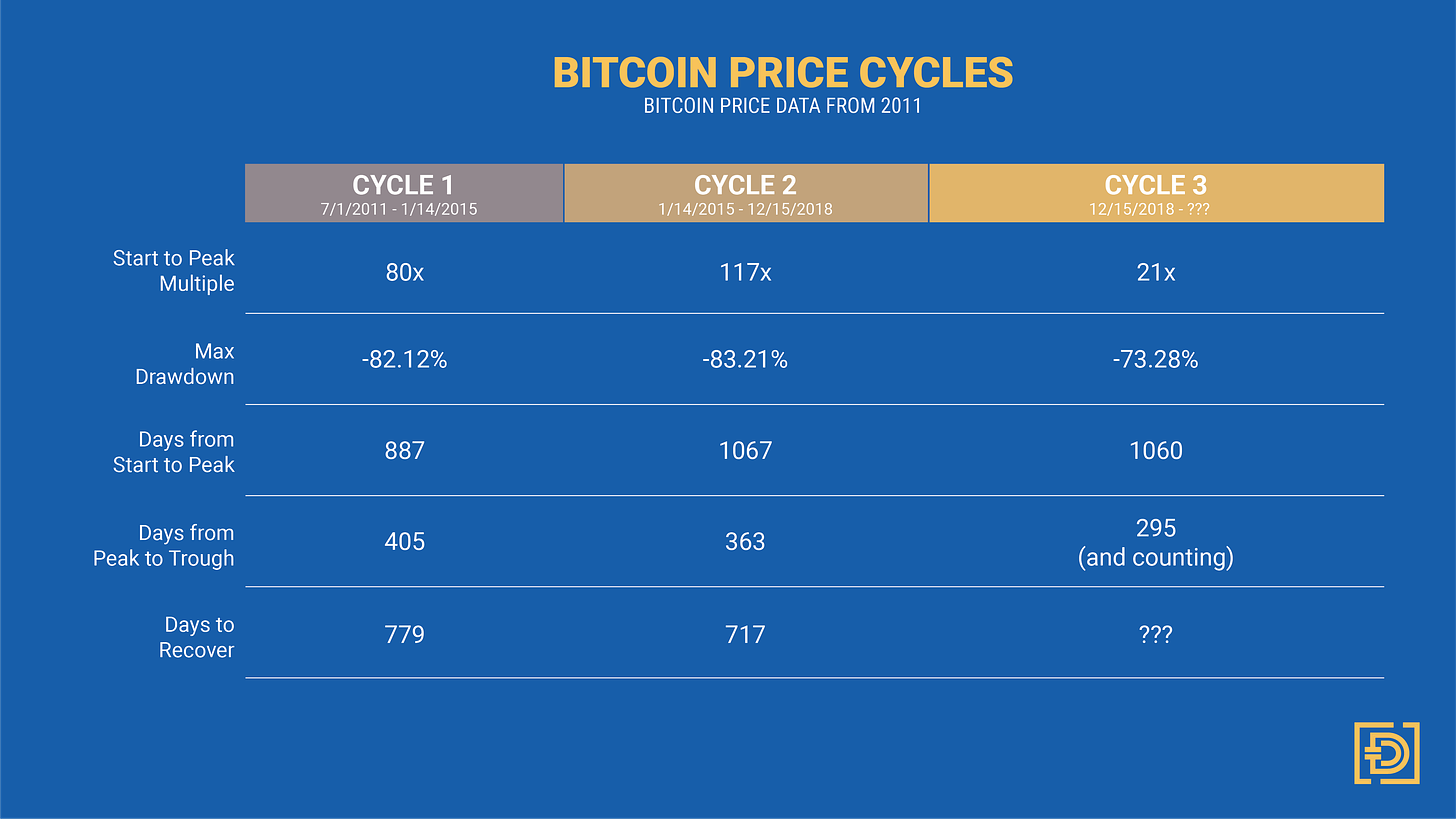

Does the long duration until the next halving mean we should stay away from Bitcoin and wait until the next halving nears? We don’t think so. Now presents a great opportunity to accumulate BTC (stack Sats). If you can commit to a Dollar Cost Averaging strategy, that would be beneficial. You don’t have to necessarily buy but having cash on hand at an exchange or held in a custodial wallet through stablecoins will present a significant advantage. The economy may be in a technical recession so there could be downside ahead but waiting too long and trying to time the bottom with money tied up in the legacy financial system could backfire. These relationships aren’t governed by mathematical laws and can change on a whim. The cycles could easily shorten and leave you on the sideline. Being invested is paramount. In particular focus your eyes on the chart below in the row that shows - Days from Peak to Trough and notice the past two cycles have had similar durations and compare it to how many days we are in now. One would be surprised how quickly you could run out of time and miss the biggest moves, which usually happen in the beginning.

-