2022 was a difficult year for cryptocurrency investors, as prices declined and instances of fraud impacted the market. However, it is important to remember that such challenges are temporary and that the long-term potential for cryptocurrency remains strong. In this post, we will discuss items that didn’t materialize and our expectations for the coming year.

- $100k Bitcoin by end of 2022

- Altcoins continuing to outperform Bitcoin

- Bitcoin moving up with rates

- Stock to Flow being the premier chart

- 2023 & beyond

- Note from the founder

- 100K - We remain confident in Bitcoin's long-term potential to reach beyond $100,000. The most likely catalyst for this growth is the upcoming halving in the second quarter of 2024. By accumulating Bitcoin over the course of 2023, investors have the opportunity to achieve significant capital appreciation through their foresight in recognizing the future benefit of digital assets. Even if it takes ten years for Bitcoin to reach $100,000, this would still result in a conservative annualized return of 20%, outperforming the projected returns of traditional asset classes. It is essential to remain forward looking and hold on to Bitcoin for the long haul.

- Altcoins - 2021 saw the rise of highly touted projects such as Decentraland, Avalanche, Solana, and Luna. Each project had their own unique use case and the investors felt the future for altcoins was bright. Then 2022 happened. All of these projects have lost over 90% of their value. In the much publicized case of Luna that number is essentially 100%. These numbers don’t even consider entities that used leverage to purchase these assets. During bull markets, it can be tempting for investors to become envious of the large gains being made by altcoins and to consider shifting their investments. However, it is important to prioritize stability in such a volatile sector. By focusing on Bitcoin and Ethereum, investors can limit their losses to the historical drawdowns of these assets, which have been around 80-90%. While a drawdown of this magnitude may seem like a point of no return in traditional investing, these two cryptocurrencies have demonstrated the ability to recover and reach new all-time highs after significant sell-offs. In contrast, other projects have not shown the same resilience after steep declines. So keep in mind when looking at altcoins, some projects may appear cheap at present but are unlikely to recover as well as Bitcoin and Ethereum.

- Rates - At the end of 2021 we came across a trend of rising treasury yields and rising Bitcoin. It was an interesting thing to track going into 2022, but unfortunately the relationship did not persist and we were back to rates up risk assets down. It didn’t help that the FED undertook the most aggressive rate hike cycle in the last 30+ years. Risk assets sold off and Digital Assets were no different. One positive of a high interest rate environment is that rates are more likely to decrease in the future. We believe that rates will likely be lower in one year. The decrease in rates would lead to an increase in the value of risky assets. If our timing is correct this will coincide with the Bitcoin halving event, which has historically led to large market outperformance. However, we should be mindful of the potential for inflation to impact interest rates. While we believe that inflation has peaked, if it does not decline, it could lead to higher rates for a longer period of time. On the other hand, if inflation were to unexpectedly rise due to factors such as rising energy or food prices, the Federal Reserve may continue to aggressively increase rates. While anything is possible, we believe that the worst is likely behind us.

- Stock to Flow (S2F) - The model created by anonymous twitter personality, PlanB, managed to capture the hearts and minds of crypto participants in 2021. Many investors waited for the S2F model’s prophecy of $100k BTC to be fulfilled by 2022. But it never happened. This underscores the problems with various models used to predict Bitcoin’s price. People get anchored to certain milestone prices and look to any source that can quantitatively put us on the path to achieving that goal. The fact that S2F broke down does not mean we are doomed. It just means that modeling the future price of Bitcoin is far more random than we may want to believe. Bitcoin’s price movement is not bound by any determinable mathematical relationship. Long term it is important to remain optimistic but don’t get attached to people who say Bitcoin will be a certain price because their model predicts it.

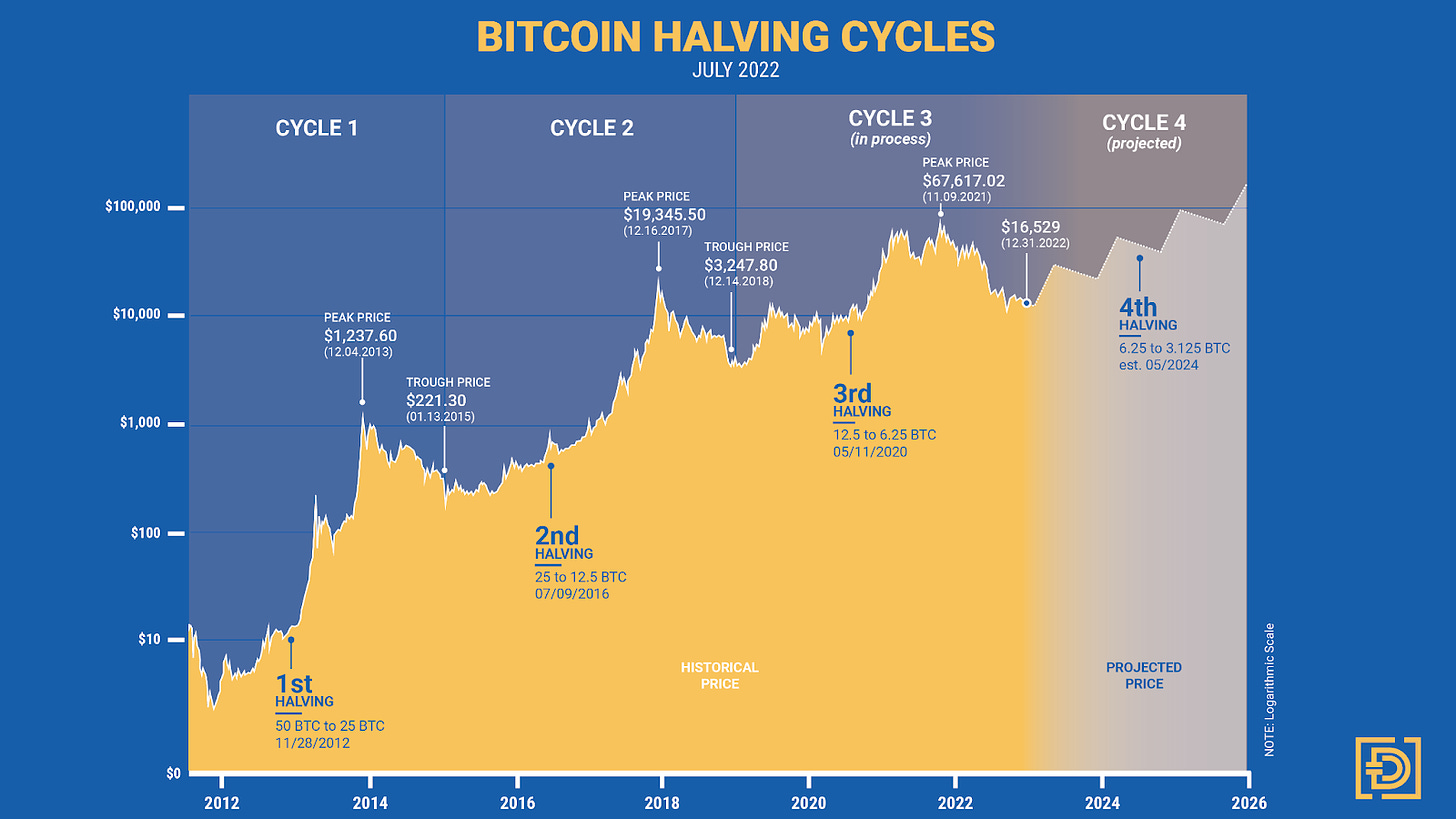

- Looking ahead - As Bitcoin has been in existence for 14 years, we can begin to analyze its long-term cycles. We think that the cycles last about 4 years. They more or less coincide with the Bitcoin halvings. Bitcoin halvings (reduction of the mining reward by ½) are programmed to occur every 210,000 blocks. With this basic framework in mind we can look back at previous cycles and get an idea of where we are heading. Our projection is that we are nearing the end of the third major cycle. The first cycle reached its peak at $1,237, and the second cycle peaked at $19,345 four years later. The potential peak of the third cycle occurred another four years later at $67,617. You can look at the chart below for a visualization of these events. Using it as a guide one would expect the price to be much higher by 2026. However, just as we mentioned with S2F these relationships are not certainties. Bitcoin could easily reach a new all time high by the second quarter of 2023. The presence of short cycles with distinct catalysts that lead to favorable performance leaves us very bullish for the future.

- Note from the founder - I’ve been in this business going on 5 years. I’ve read all the headlines and tweets but have also seen the interworking of the business side of the industry. This is not the first turbulent time in the cycle and it won’t be the last. Despite the negativity there are developments that show growth and reassurance. For example; the largest Bitcoin ETF uses Gemini for a custodian, thread here. Gemini has enable JP Morgan to facilitate cash transactions for DAIM clients, and the Bitcoin Hash Rate continues to increase, see here. It is important in these times to filter what is positive and negative as investor alongside you. I've seen that a long term positive view has shown to be the best mindset.Thank you for being a client!Bryan CourchesneCEO

DAIM