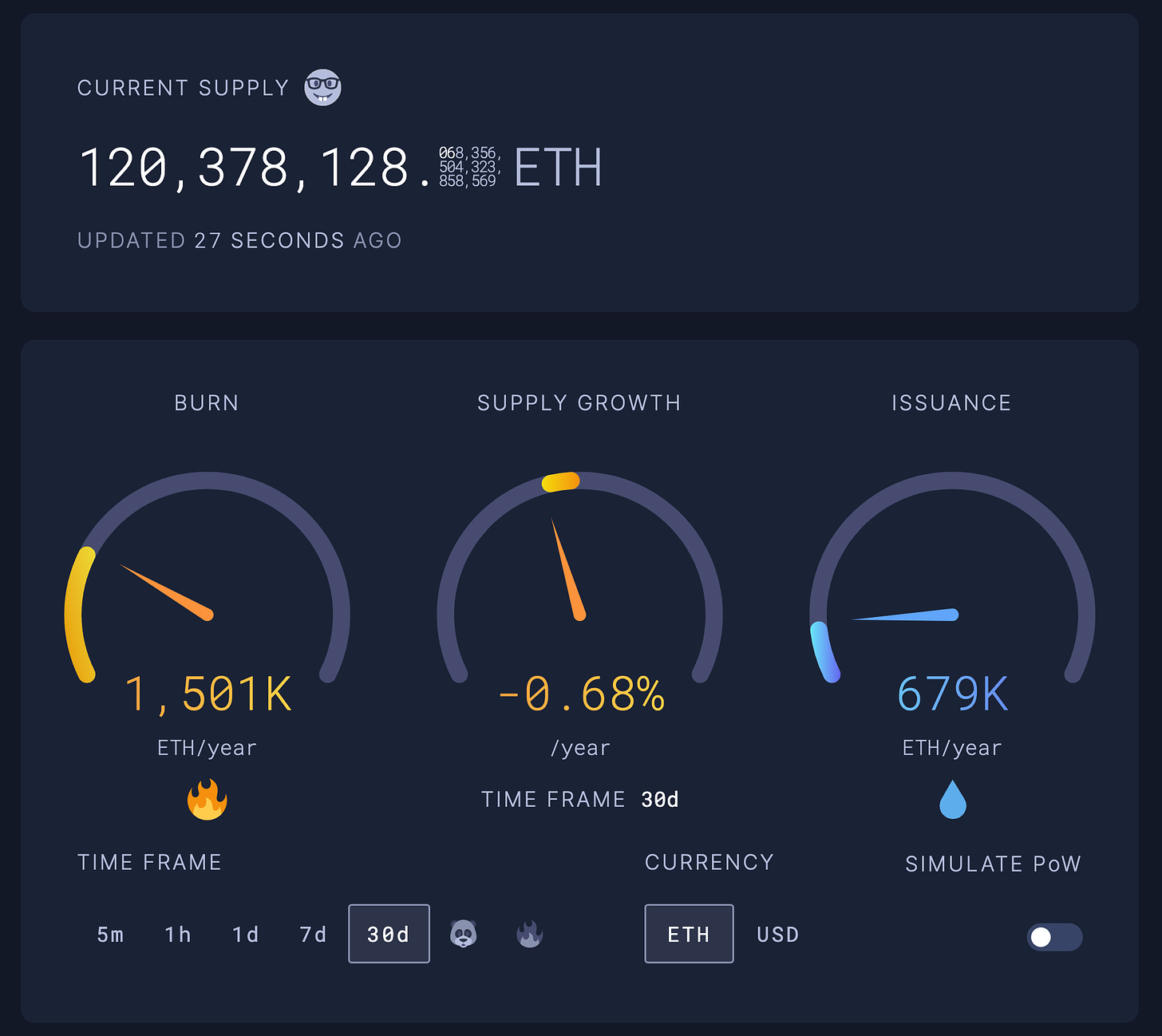

If The Merge can slow the inflation rate or even make ETH a deflationary asset then the ETH fundamentals get stronger. One of the main selling points for investing in Bitcoin is its scarcity. Conversely one of the main reasons for the myriad of altcoins failing was their runaway inflation (see Luna). Ethereum’s supply has always been much larger than Bitcoin’s. If the reduction in supply keeps up and demand increases we likely will get a more positive price response.

Ultimately the long-term investment case will depend on upgrades still to come. Let's look at the most recent Ethereum roadmap.

Without getting into the weeds, the goal of each step (aside from rhyming) is to get Ethereum to a place where transacting is fairer to all users and the network can handle 100,000 TPS (through roll-ups). We are currently at 30 TPS. If Ethereum can accomplish the 100,000 TPS goal then the network can handle spikes in demand much more easily. Paying hundreds of dollars in gas fees to buy an NFT could be a thing of the past. We are still a long way from implementation and deadlines do get pushed back but as more dates become known this could set up a bull case for outperformance vs Bitcoin.