March 7, 2022

We continue to standby BTC swinging between low $30Ks to upper $40Ks. Each time BTC trends down, the altcoins without substance will have their market cap reduced aggressively. The crypto market can stay oversold longer than most buyers can stay solvent. Bitcoin needs to continue to clean out the system.

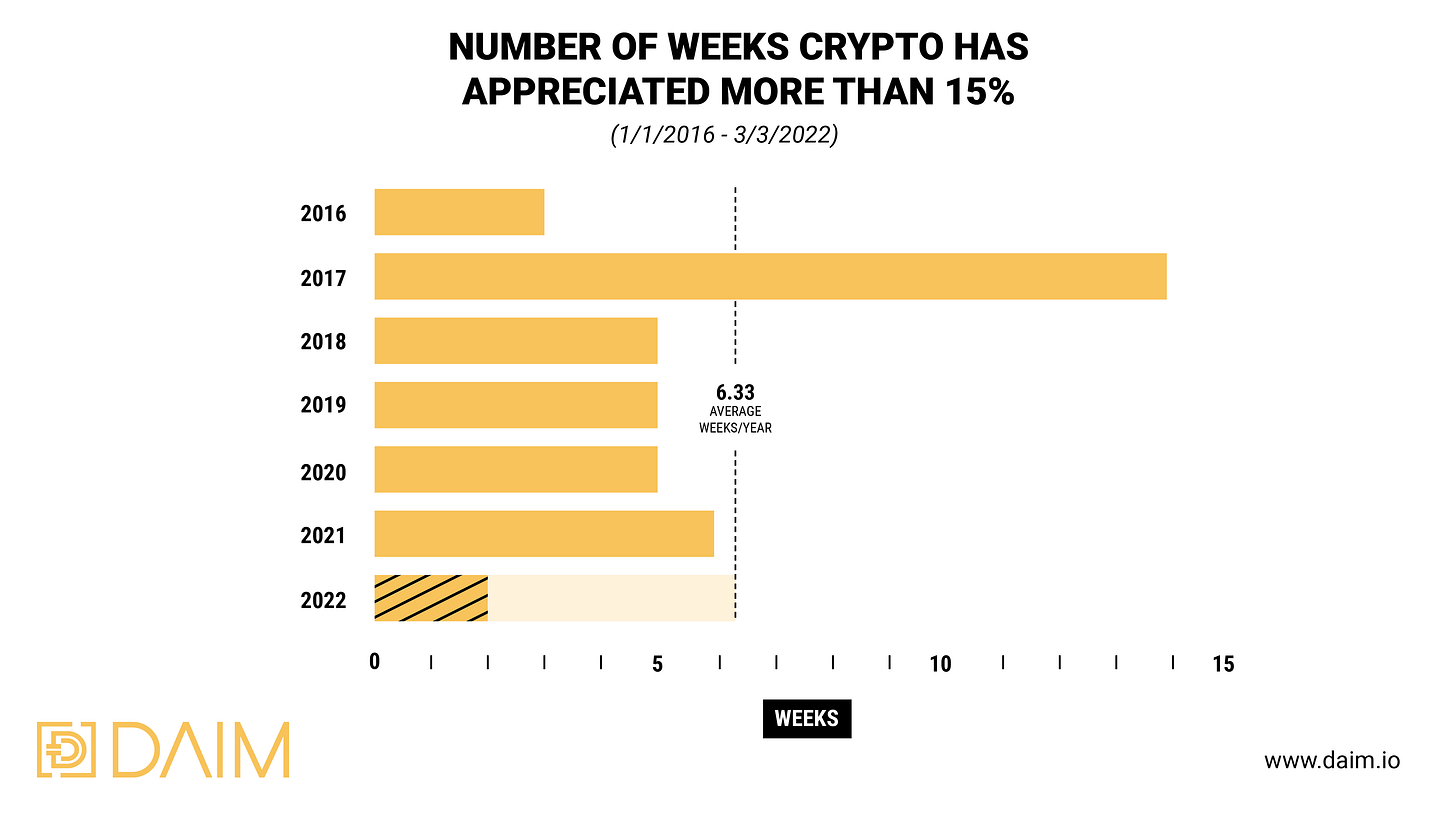

How would you like it if your investment returned 15% in a given week? Chances are you would. With Digital Assets a 15% return happens more often than an investor in a traditional asset class would expect.

While Digital Assets may not have become a widely respected asset class until recently, for our purposes we will look back at market returns since the beginning of 2016. Since then the total crypto market cap, on average, has appreciated more than 15% in a given week 6 times per year. Compare this to the S&P 500 which had ONLY one 7-day period since 2016 where it appreciated more than 15%. Digital Assets will reach that stabilizing point sometime in the distant future but until then investors should expect much of the same growth that has been present the last decade. Obviously returns are a two-way street, but over time Digital Assets (Bitcoin and Ethereum in particular) have shown strong, positive asymmetric returns. Our data suggests that investing early and often (DCA when possible) will provide an investor with impressive returns.

So where do we stand so far in 2022? Digital Assets have had two weeks of 15% returns. While there is a lot of uncertainty regarding macro influences such as rising interest rates and geopolitical turmoil, investors should still see these levels as a good entry point. History has shown we can still expect 4 big weeks to come this year. It’s no guarantee, however we now have 5 plus years of demonstrated ability to generate large excess returns.

DAIM invested in Digital Power Optimization (DPO) through NBDR Ventures, alongside NYDIG. DPO is a BTC company that manages miners at power producers.

At DAIM we want to continuously improve our service and operation while growing strategically. We are proud to announce that Mark Hartsell, President of CEO Advisor, Inc., has become a business advisor for DAIM. Mark has an MBA from Loyola University, achieved a certification in Mergers & Acquisitions from the Wharton School of Business, and is a member of Tech Council and Octane. Since 2004, he has been helping companies accelerate growth, increase profits, and build value. Mark’s specialization is in growth capital and mergers and acquisitions.