1. Goldilocks

For years the 60/40 portfolio has been the poster child of conservative retail investing. It was widely viewed as a “Goldilocks” allocation, one that was just right for most individual’s risk profile and one that would perform favorably under many macro conditions. It just so happens that we may be experiencing market conditions that make this portfolio the wrong choice for investors. Monetary and fiscal policy, as well as supply chain issues, since the onset of the pandemic have created an inflationary environment that could be especially deleterious to bond investors going forward. And if you are a 60/40 investor almost half of the portfolio will have exposure to an asset that will struggle to keep it’s head above water.

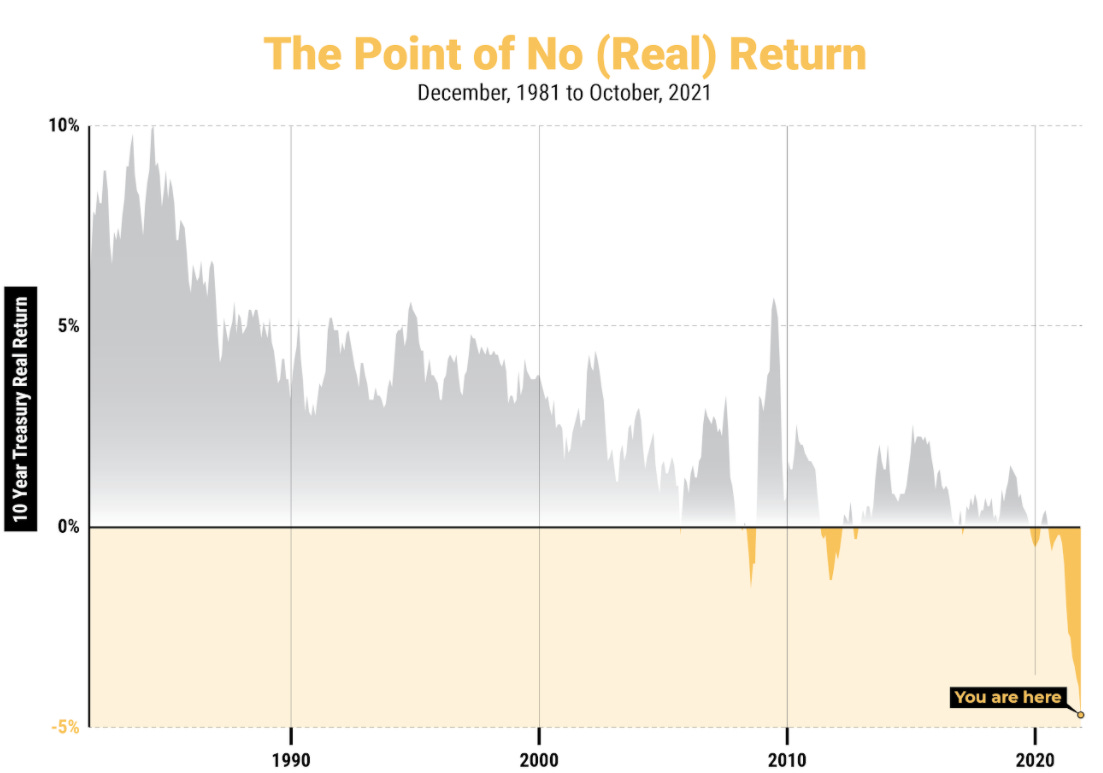

2. The Point Of No (Real) Return

The math is pretty straightforward. Interest rates are low, 10-year treasuries are yielding 1.4% as of writing. On the flip side inflation is high: official numbers show the latest YoY CPI print of 6.2%. This is the largest year over year increase in 3 decades, and there is a good chance true inflation is underreported. Even if the numbers are indeed accurate, this presents a sobering picture for investors. For illustrative purposes we used the 10-year treasury because it has the risk profile of a conservative bond with no credit risk and a moderate duration. This should generate modest (and hopefully positive) returns for investors while not jeopardizing the capital they invested. Now think of inflation as the hurdle rate for an investment. A rational investor would not want to hold an investment if it was guaranteed to lose money over time. However if 10-year yields are currently at 1.4% and inflation is 6.2% you are locking in a real return of -4.8%. Not good. Looking at the chart below, real returns for the 10-year are at their lowest point in 40 years. It remains to be seen if rates increase, but unless they move in a quick and drastic way it may not make a difference for a while. That means we could be entering a period where investors are buying assets that are guaranteed to lose money after accounting for inflation.

So if bonds are a bad choice where should you allocate your money? The obvious answer, if you find yourself reading DAIM’s blog, is Digital Assets. We feel that a rotation out of bonds into Digital Assets would be a prudent move for at least the near future. While we feel comfortable with a large allocation to Digital Assets we are going to show the benefits of rotating only 10% of a 60/40 portfolio into Digital Assets, specifically Bitcoin. This rotation is important for all investors but we are going to lay out why it is especially prudent for investors who are near retirement.

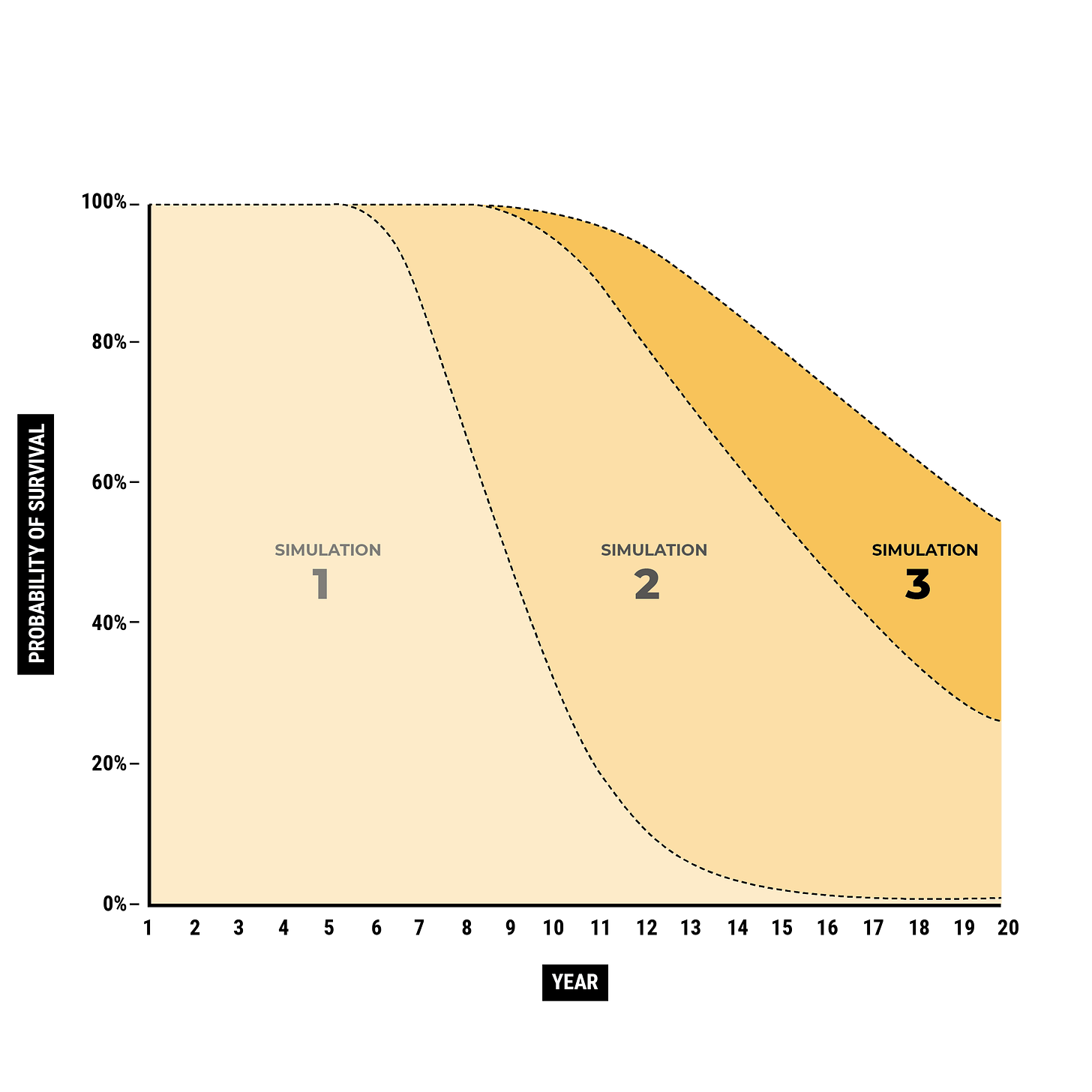

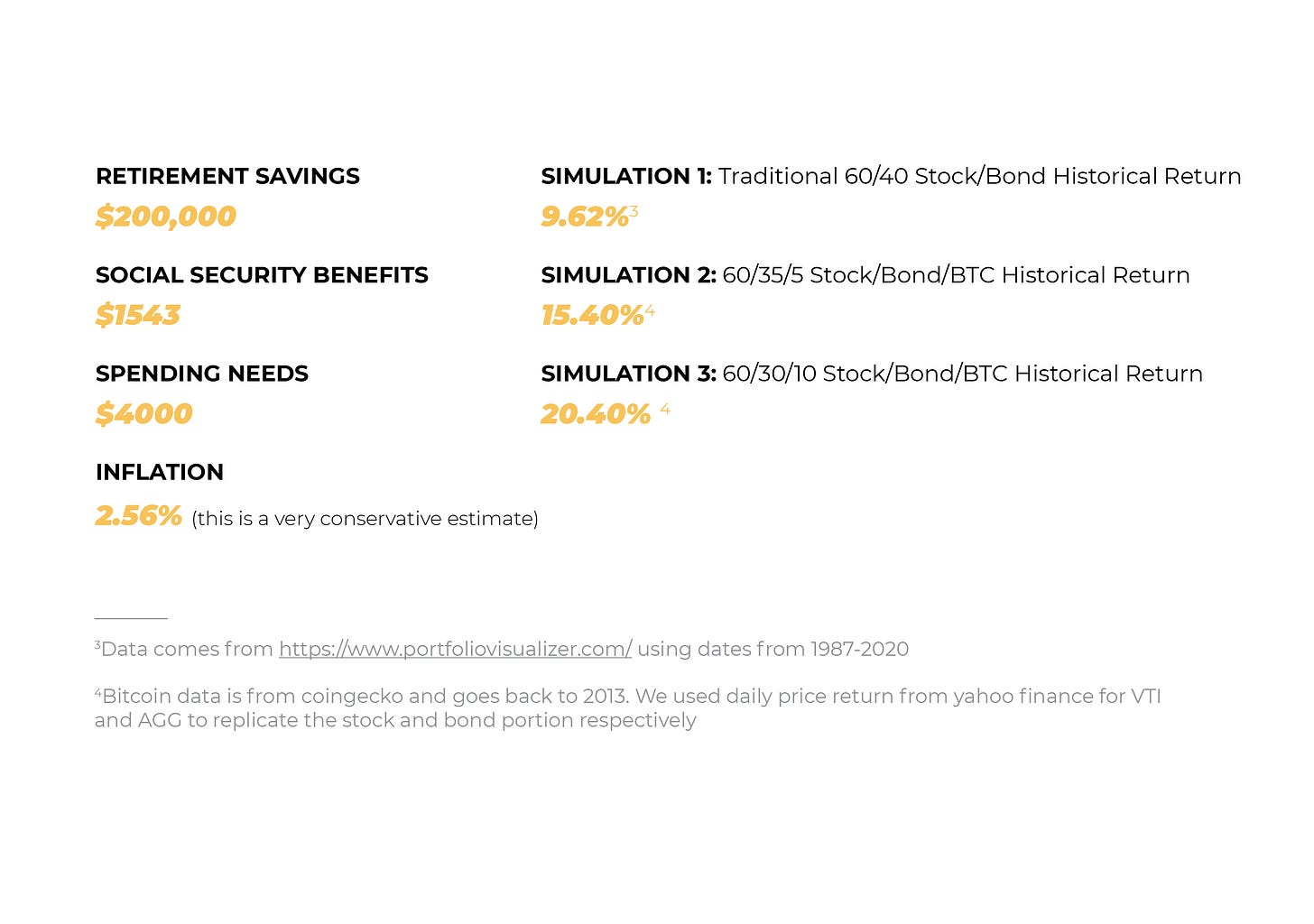

3. 60/30/10

As we outlined in our video above, Baby Boomers are perhaps the most vulnerable group of investors. The reliance on bonds to provide stability and income seems to be a thing of the past. Going forward investors will have to be more proactive in finding alternatives to generate meaningful real returns and in many cases make up for spending deficits they may have. For most people turning 65 their nest egg won't last them long. High monthly expenses coupled with meager social security and increased longevity risk mean the majority of boomers will outlive their retirement assets if they invest in a basic 60/40 portfolio. Moving just 10% of bonds into Bitcoin produced staggering results. We ran Monte Carlo simulations that showed this simple rotation from a 60/40 portfolio to a 60/30/10 allocation increased our expected return from 9.62% to over 20.40%. This would allow investors to keep pace with inflation, and would also provide the necessary cushion that is needed to deal with all of life's uncertainties. Keep in mind that while the volatility of the portfolio will increase, on a risk adjusted basis the portfolio maintains a decided edge. We specifically looked at the probability of survival 20 years into the future for a typical retirement account, and if the volatility of the portfolio was too high we would not expect the surviving accounts to increase dramatically no matter how high the expected return was. But they did. Fewer than 1% of 60/40 portfolios made it 20 years. However 55% of our portfolios made it with just a modest Bitcoin allocation. Here the risk is clearly worth the reward.

4. Forecast

Our beginning of the year price target of $90k Bitcoin by the end of 2021 is no longer in play. The day after Thanksgiving those traders who went to work decided that the Omicron Covid Variant was going to be a grey swan, this topic continues to roil the markets. The macro selloff changed technicals and has now elevated the FED meeting on December 14th & 15th to the main event. We foresee digital assets trading in a 15% wide channel from where they currently are until that event. If Omicron forces closures, the FED will likely leave forecasted future rate movements as is and all markets will rally. If worries subside we see the FED making a move towards tapering. Then it's likely all volatile assets will sell off. But this will likely be short lived as money is still working its way down through the system and will need places to go (into fixed supply assets like Bitcoin). Because at the most basic undeniable level, inflation is real and investors need a hedge.