Since June 30th of this year all California companies with more than 5 employees are mandated to offer their employees a retirement plan. The most convenient option is to enroll in the state sponsored CalSavers retirement savings program. But is it the best option? No. The program has many drawbacks compared to what we can offer. Read below for some important distinctions between CalSavers and a traditional 401K managed by DAIM. You can read our critique below or scroll to the bottom for a summary chart.

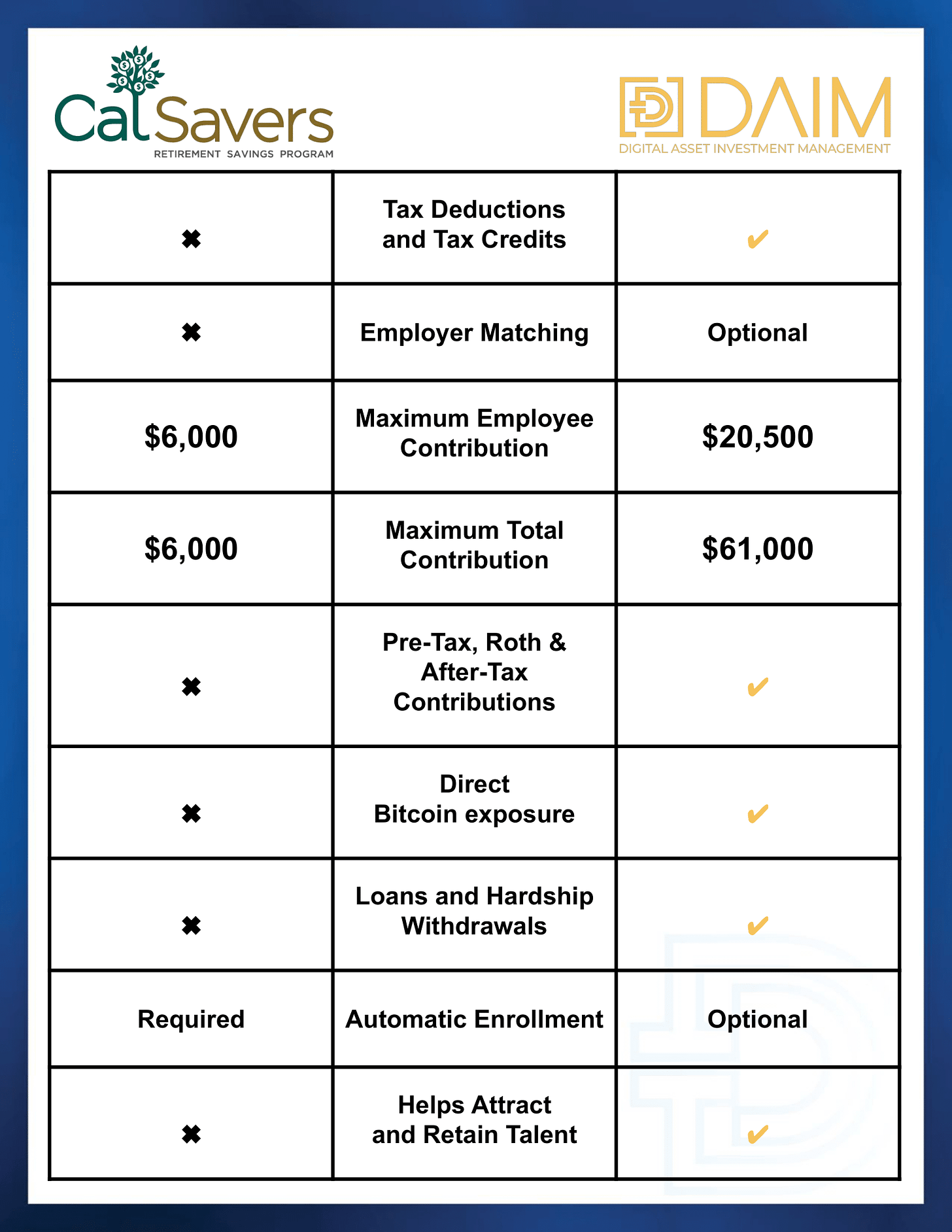

Tax deductions and tax credits - The CalSavers plan is a Roth IRA. That means all contributions are made on an after-tax basis by the employee. Since the contributions have already been taxed, they cannot be counted as deductions when the employee files taxes. A 401K plan can be set up to allow before-tax, after-tax, and Roth contributions. The flexibility afforded to those who use a 401K makes it much more desirable. Additionally, launching a new traditional 401(k) plan allows employers to qualify for up to $5,500 annually in tax credits during the first three years of having a new 401(k) plan in place. There are no tax credits with CalSavers.

Employer Matching - CalSavers does not allow for employer matching. Only employees can contribute to the program. Traditional 401Ks, like the ones we manage, allow for employers to match employee contributions. While it does increase costs marginally, its benefit is immense since it allows employers to attract better talent since the matching contributions are free money for participants.

Maximum Employee Contribution - As previously mentioned CalSavers is a Roth plan, which bounds participants to the contribution limits of a Roth IRA. For 2022 the limit is $6,000. In addition Roth IRAs have income limits for participants. If an employee makes more than the limit, they will be forced to opt out of CalSavers, essentially defeating the point of requiring employers to adopt it.

Maximum Total Contribution - Since employer contributions are not allowed into a Roth IRA, employer contributions are not allowed for a CalSavers plan. This caps Calsavers at a max contribution limit of $6,000. For a 401K the max limit jumps to $61,000 including employer matching. For employers who are looking to provide employees with benefits, the ability to contribute to a participant's retirement plan is very important. With our plan an employee could save $55,000 more each year!

Direct Bitcoin Exposure - This is our specialty. One of the main issues holding 401Ks back is the lack of direct exposure to alternative assets. The vast majority are constrained to mutual funds. CalSavers is no different. While a mix of mutual funds is not necessarily a bad investment choice, it prevents participants from creating a more robust portfolio that will prepare them for retirement when the time comes. Research is showing that the gold standard for a retirement portfolio, the 60/40, is not providing investors the benefit that it historically has. This could potentially leave retirees underfunded when they exit the workforce. Our plan gives participants the ability to allocate up to 10% of their contributions to pure Bitcoin. This is Bitcoin bought directly off a leading US exchange and held in a Bitcoin wallet. This pure exposure eliminates the tracking error that has led to underinvestment in products like GBTC. Adding direct exposure to an alternative investment like Bitcoin has shown to improve retirement outcomes for defined contribution plan participants.

Loans and Hardship Withdrawals - A CalSavers plan will not allow a participant to take out a loan against their portfolio. In addition they do not allow hardship withdrawals which may be necessary due to a medical or financial emergency. While letting investments sit and compound over time is ideal, life often has other plans and the flexibility of loans and withdrawals within a 401K plan are another reason why it is the preferred vehicle.

Automatic Enrollment - Although retirement savings are important, it doesn’t mean employees should be forced into it. CalSavers has automatic enrollment for participants. For those not wishing to participate, they must opt out. If for whatever reason someone is unable to opt out in time they could find themselves contributing to a Roth IRA when they exceed the income limits. Undoing this involves taxes and penalties for excess contribution. With a 401K plan managed by us, participants are in full control over their money and are only contributing because they want to.

Attract and Retain Talent - In a competitive hiring environment, employers need every edge they can gain. A comprehensive benefits package is a great way to differentiate yourself. Furthermore a 401K plan with higher contribution limits and the ability to invest directly in Bitcoin will be much more attractive to candidates.

Helping your employees save for retirement is important and you have to start somewhere, so CalSavers is certainly better than nothing. But we feel employers are doing a disservice to themselves and their employees by using an option that is lacking in so many areas.