Digital Asset Performance vs TradFi

2021 was a dream year for crypto. The entire crypto market was able to sustain momentum built in the second half of 2020 and push the space to all time highs. Total cryptocurrency market capitalization reached a high of $2.8T in November after starting the year at just $800B. Even during the summer selloff, total market capitalization only dropped to about $1.2T. Sustaining valuations at these levels helped reinforce the legitimacy of Digital Assets and should promote continued capital inflows from traditional markets. Bitcoin and Ethereum smashed previous ATH with BTC getting to $69,000 and ETH eclipsing $4800. Overall the total crypto market cap grew about 200% in 2021. Bitcoin, seen as an underwhelming performer, was still up 60% in 2021. Traditional markets continued to bask in low interest rates and an expanding FED balance sheet. Even in this favorable investing environment, the SP 500 is up only 27% on the year. Great in traditional terms but obviously not as great as Digital Assets.

Random Thoughts on Trends

As we mentioned, many sectors within Digital Assets were living the dream in 2021. We feel some of these sectors could continue to mature and reshape the ever evolving landscape of Digital Assets. Layer 1 solutions, most notably Solana but also DOT, AVAX, MATIC, and LUNA to name a few also thrived. People stepped into the metaverse, showing that decentralized gaming platforms like Sandbox, Decentraland, and Axie Infinity could deliver and sustain active user engagement and excellent ROI. There are other sectors we aren't so bullish on, if at all.

NFT’s became all the rage this past year with 6 pixel images easily fetching 6 figure sums. The idea of art ownership being recorded on the block chain shows the utility of the space. We’re lukewarm on how much more room there is to grow but we are cautiously monitoring as the space develops.

One thing we don’t foresee lasting, or at least hope it doesn’t, is meme investing. It's an idea that began in the traditional world with Gamestop stock and continued into the Digital Asset space with Dogecoin, Shiba Inu, Dogelon Mars, PHAYC, etc. The thesis behind these coins seems to be the desire to be in on a joke, and the delusional thought that the prices could soar to heights that would make their respective market caps dwarf Bitcoin. Dismissing fundamentals and utility in favor of being in on a joke is not an investing strategy with staying power.

End of November Sell-off/Moving Sideways

Bitcoin was down over 5% the Friday after Thanksgiving. This was attributed to Asian institutions taking profits, which was mimicked by US institutions. Stateside, as prices went lower, the opportunities to tax loss harvest became more attractive. The typical blueprint for tax loss harvesting is to sell and buy right back in an effort to retain the same units and locking in the loss. However, we saw a growing number of investors who instead added selling pressure by dumping and then slowly allocating back in (not recommended btw). Separately, when prices were at all time highs this year, the projected trade was to sell in Jan’22 in order to not add to 2021 taxable income. This likely has changed and these would-be upcoming sellers will probably wait for new all time highs in 2022 before selling.

Rate Hikes And Effect On Crypto

It goes without saying that interest rates have nowhere to go but up. The Fed cut rates to 0% at the onset of the pandemic in early 2020 and the prevailing sentiment is that we are due for multiple rate hikes in 2022. At their meeting in mid-December 12 out of 18 FOMC members predicted at least 3 rate hikes in 2022. Generally, as interest rates increase, the price of risk assets moves in the opposite direction. However, in a December 20th Pomp letter a recent trend was presented showing Bitcoin prices and the 10 year treasury yield to be positively correlated. If this plays out long term, Bitcoin could become a great inflation hedge. Inflation is running hot right now and rates will need to move up to maintain some semblance of a real yield. If Bitcoin is seen as the ultimate form of hard money, one that is a safe haven in inflationary times, and one that can move up with interest rates, then 2022 could be a lock for six figure Bitcoin. Obviously this relationship between rates and Bitcoin has been observed for only a few months but we are optimistic on it continuing.

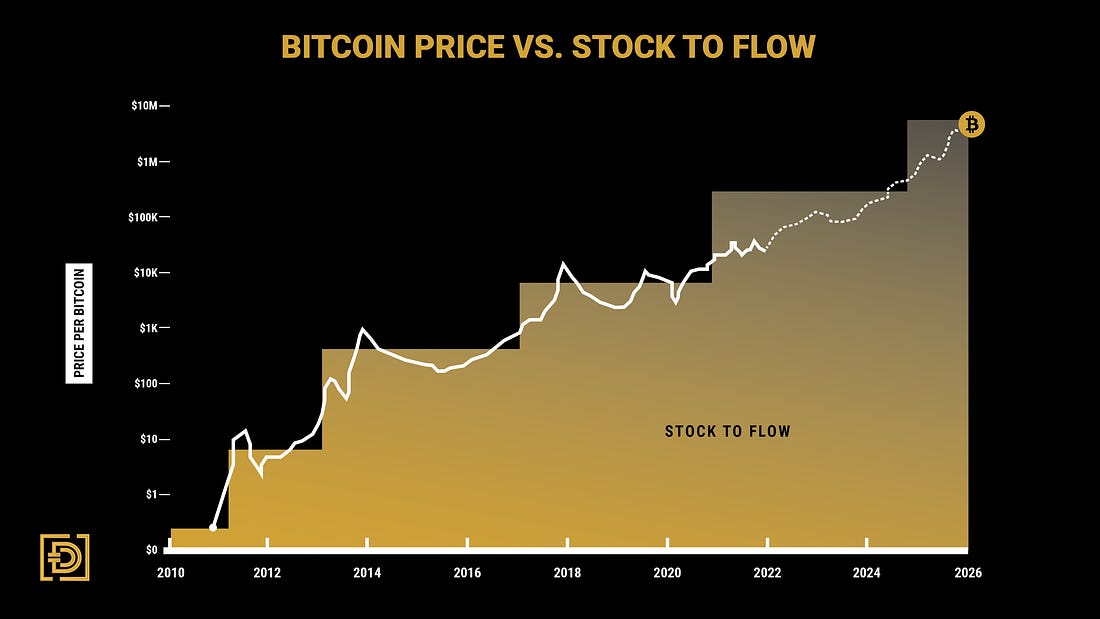

Back on Track for Stock to Flow

The Stock to Flow model by PlanB is praised when Bitcoin prices are following the line or at least moving towards it. And he and the model are discredited when prices move away from the line for a sustained duration. If a full 12 months goes by and BTC prices are still disconnected, new charts and technicals will become the more favorable gauge. But we find this unlikely and feel that prices will move back towards the model’s line, reinforcing Stock to Flow as the premier gauge for future price predictions.

Where Crypto Can Outperform in 2022

For retail investors it is important to keep perspective when chasing performance in digital assets. A portfolio of Bitcoin and Ethereum might seem boring and fail to deliver the returns of some en vogue altcoins but that is burying the lede. A portfolio of Bitcoin and Etherum holds two of the riskiest assets an investor can purchase right now. Going long in the top two digital assets should deliver excess returns over a traditional mix of stocks and bonds. There is no need to overthink things. We don’t think a crypto portfolio can be too overweight Bitcoin and/or Ethereum. Nonetheless, here are some worth researching. For Layer1 smart contracts - Luna, Avalanche, and Kadena. For level DeFi options we like Loopring, DYDX, and Balancer. For gaming/metaverse we like Sandbox and Axie Infinity, though we feel like the user base has to catch up to their recent price run up. Again Bitcoin and Ethereum should outperform legacy assets in the years to come, but if you want to try to outperform your outperformance, you can research some of the names above.

Lately Ether has been experiencing institutional withdrawals and whale selling, likely attributed to the success of other layer 1’s and 2’s, and uncertainty around the final transition to full Proof of Stake. In early 2022 ETH may move more in tandem with BTC and see outperformance resume when ETH Phase 2.0 completion becomes more defined.

2022 Crypto IRA Allocation

A common goal is to get IRA money to work early in the year to keep IRAs maximized. Go over your suitability and then notify us that you want to make a contribution by emailing [email protected]

Account Allocation

We’ve often heard others say “I wish I had invested more back then.'' If you are under these weightings it's not too late to increase.

Recommended Allocation to Digital Assets

Corporate balance sheet 10%-50%

Institutions 10%-40%

High Net Worth Individuals 10%-40%

Young or high earners 10%-50%

Those in or near retirement 1%-10%

Even the most skeptical investor should hold 5%

When in Doubt, Zoom Out

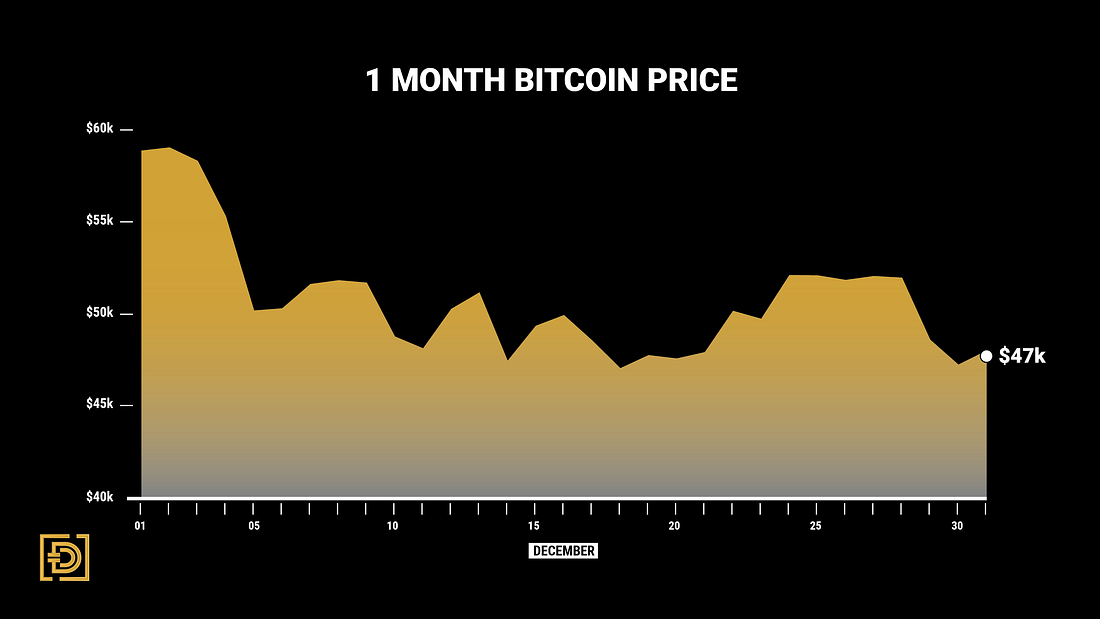

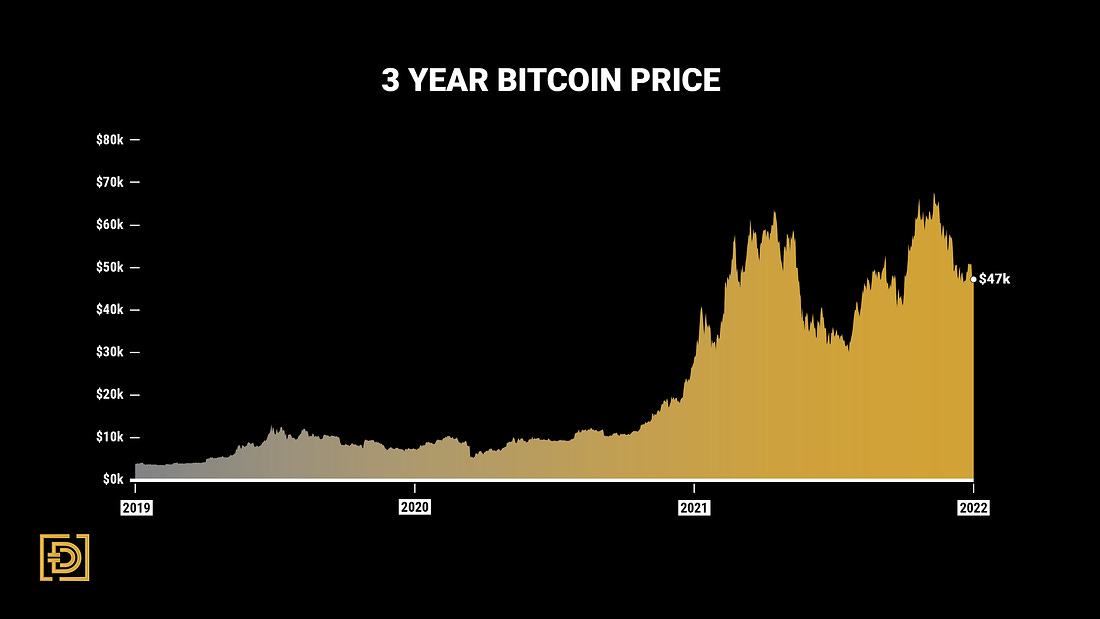

There is a saying in investing: “When in doubt, zoom out.” The idea is that asset prices tend to appreciate over the long term so if you get hyper focused on a recent dip, zoom out, look at a much longer time horizon and see that the price will recover and you will find yourself in the upper right hand corner of a chart. Never has this idea been more true than in the extremely volatile Digital Asset realm. Look at the one month Bitcoin chart below.

Not ideal. We’re down about 20%. But like we said if you have doubts then you need to zoom out. Now look at the 3 year chart.

All better. Bitcoin is up about 1200% in the last 3 years. The point we want to make is that long term this asset class has rewarded people who got in and patiently held. Time in the market is much more important than timing the market if you have a time horizon that is years long.