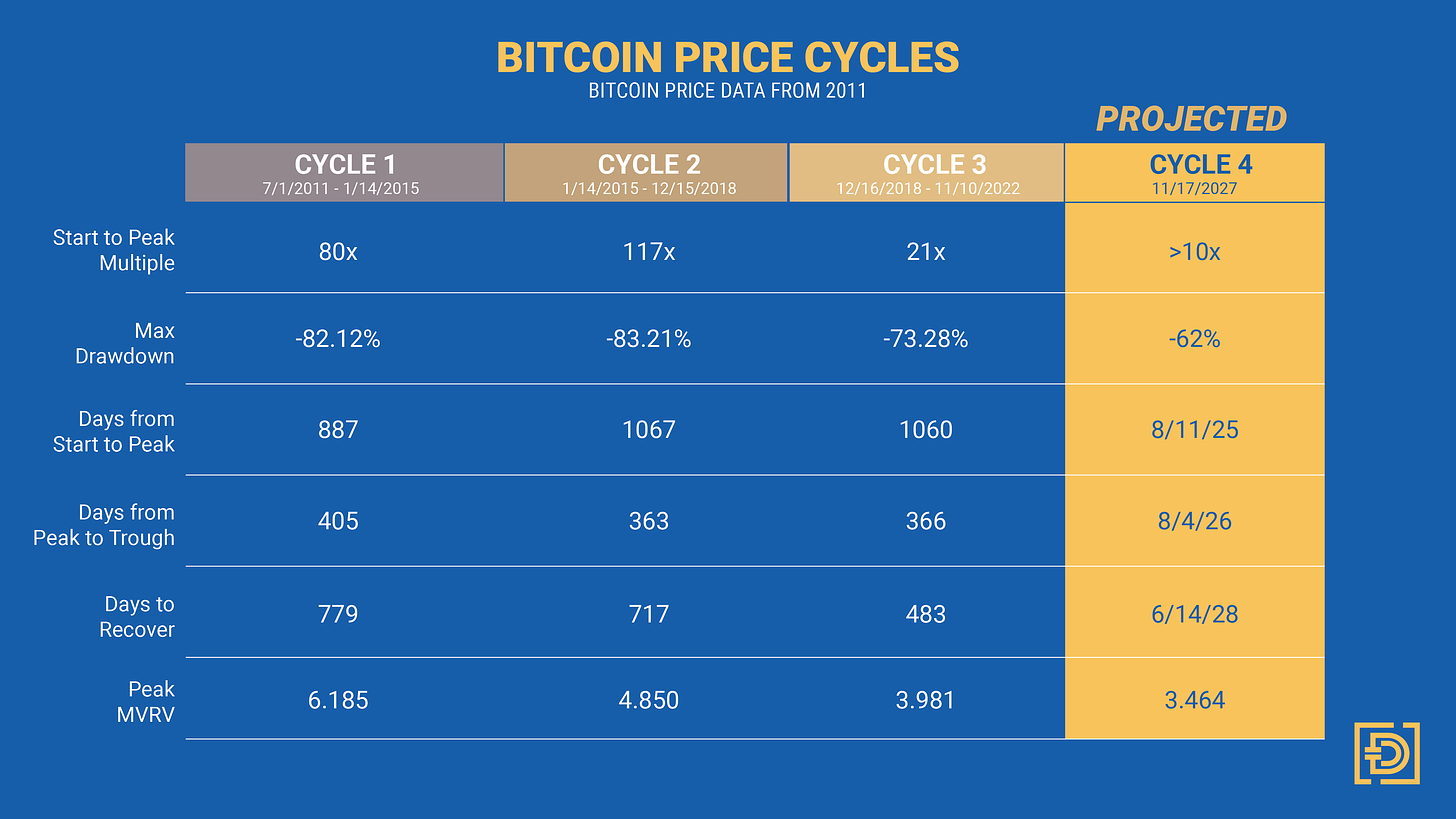

Start to Peak Multiple - Typically these cycles start and end at the bottom. So one popular metric is to look at how far bitcoin rises once it finds that bottom, or trough, price. In the first and second cycles, the returns were astronomical. The multiples were well above 50x in both cases. Admittedly bitcoin was hardly considered an investable asset in the entire first cycle and for much of the second. But during cycle 3 it was a mainstream global asset and it still managed to be a 20-bagger if you bought the bottom. Going forward it may seem like it's harder to achieve these kinds of returns given the unprecedented run-up to this point, but we think a 10x return from the bottom is reasonable. The price bottomed/began last cycle at 15,740 in November 2022. Since then we've done about a 4.5x to get to roughly $70k. To get a 10x or a bitcoin price of $157,400 the price essentially just needs to double. The greatest price appreciation historically has happened after the halving so the fact that we have experienced a 4.5x pre-halving makes doubling from here seem highly attainable. We still have more institutional capital to flow in that we feel could be a catalyst at some point. Remember Vanguard, with over $7T (as in trillion), still does not allow clients to buy spot BTC ETFs. When this switch gets flipped it could push demand significantly higher. And it’s not out of the question we get another national state to buy in a meaningful way like El Salvador. If these things happen, $157k will certainly be within reach.

Max Drawdown - This is a tough one for digital asset investors. If you’ve experienced at least one cycle you’ve seen your assets lose more than 70% of their value. You probably wished you had just bought bonds as bitcoin was falling. But the drawdowns are pretty similar from cycle to cycle and more importantly the price always recovers to new all-time highs. Going forward we still anticipate drawdowns greater than 50% but we think they will be less severe. The inflow of institutional liquidity and retail liquidity increases the likelihood of bitcoin catching a bid on a large sell-off. This makes a future drawdown of around 60% more likely to end this cycle.

Days From Start to Peak - Bitcoin is an asset with specific rules that are hardcoded. This helps create the observable cycles that repeat around each halving. There is a block every 10 minutes and the block reward is halved every 210,000 blocks. Going by those parameters you get a halving event every 4 years. This supply shock has driven past rallies and subsequent pullbacks help create the distinct peak-to-trough cycles. By calculating the duration of these cycles we can give a more definitive timeline for when certain actions should occur. Looking deeper at Days From Start to Peak, the last two cycles it has taken almost the exact same amount of days (1060) to go from the start (previous cycle trough) to the current cycle peak. Projecting this out we have the next peak around August 2025. This obviously isn't science but based on history this would be a great point to take profit.

Days From Peak to Trough - This one is right around 1 year. Bitcoin has had some intense sell-offs. And the major ones generally only take a calendar year to find the bottom. The fact that these sell-offs happen quickly means that bounce-back also comes quickly. If you are patient you will be rewarded. We like the 1 year mark so if we expected this cycle peak to hit in August 2025, naturally the subsequent trough would be realized around August 2026.

Days to Recover - As we just said the bounce back does happen quickly. In fact, the last cycle was the quickest recovery from the trough price to the previous all-time high. It took bitcoin only 483 days from hitting the bottom to re-cross the previous high, reached in November 2021. We think that this length will keep shortening as more participants enter the crypto market. With more participants and more liquidity, the market will become more efficient and the bitcoin price will experience more fluid price discovery. The days of bottom-feeding a 75% pullback are probably over and investors will have to be more ready to pick their entry point.

Peak MVRV - MVRV or Market Value to Realized Value looks at the current price of bitcoin relative to the last time it was moved. For example, let's say a hodler bought a bitcoin for $14K and the current market price of bitcoin is $70K, the MVRV associated with that bitcoin is 5 (70/14). A higher MVRV is better for market participants as it most likely indicates the price of bitcoin is much higher than when market participants made the purchase. Bitcoin’s meteoric rise in its early days led to an MVRV that was very high and has gradually come down as more bitcoin is distributed via the mining reward and more market participants buy, sell, and transfer bitcoin. Looking forward we think that an MVRV of around 3.46 will indicate a frothy market and could signal the peak bitcoin price for the cycle.

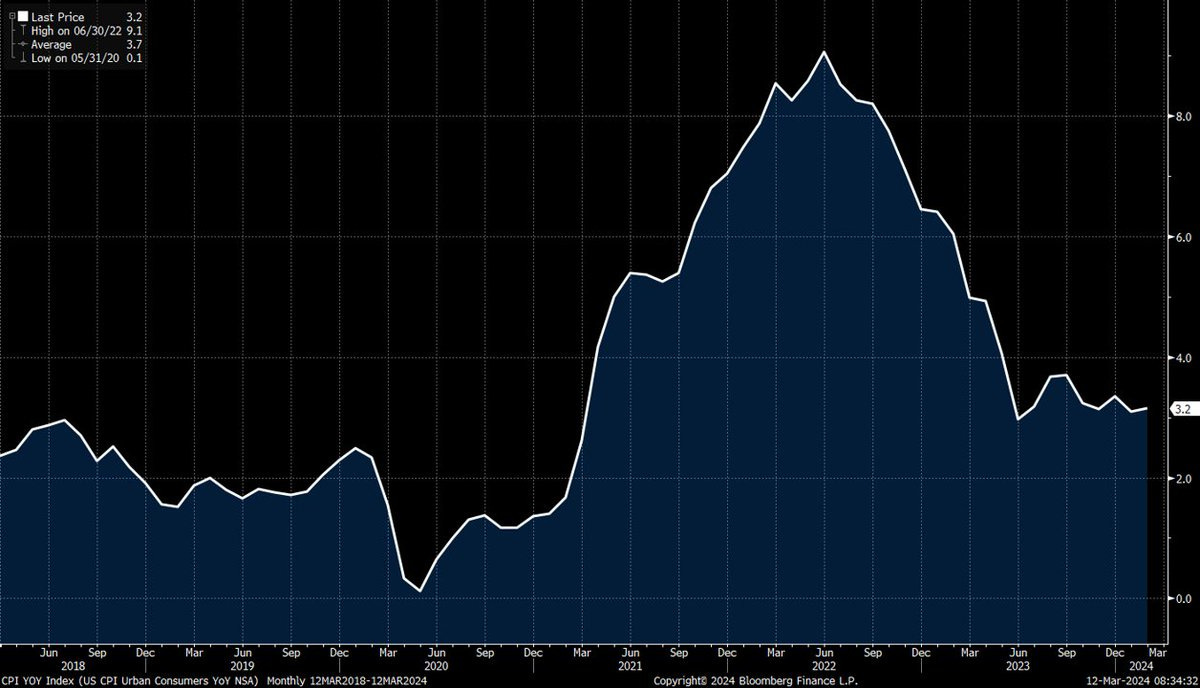

If our assumptions play out and we are in a new high-inflation regime, what does that mean for bitcoin? We think that it is good for bitcoin. A high inflationary environment is best combated with assets, and the harder the better. While stocks, real estate, and commodities should do well, none has a fixed supply dynamic and accessibility like bitcoin. Stocks and commodities have an inflating supply and direct real estate ownership is not attainable in the way that bitcoin is. Try to buy $1000 worth of a building or land, and then try to buy $1000 worth of bitcoin. Bitcoin is the clear winner for working-class people who don’t want to get left behind. There will be volatility along the way but if you hold bitcoin for the long-term your patience will pay off.