Gold has long been touted as an inflation hedge and flight to safety for a weakening dollar. Its reputation as the premier hard asset no longer holds. Bitcoin is scarcer, more durable, more portable, more divisible, and immutable. If someone gave you gold could you tell if it was counterfeit? Now take bitcoin. If you had a bitcoin wallet you would know definitively if someone sent you legitimate bitcoin. We think that bitcoin is a superior hard asset. It has been a better investment in its short history and we think it will be a better investment in the long run. Warren Buffet in his 1987 Berkshire letter to shareholders quoted Ben Graham, writing "In the short run, the market is a voting machine but in the long run it is a weighing machine." The early votes are in and bitcoin is winning. Will it outweigh the competition in the long term? We think so.

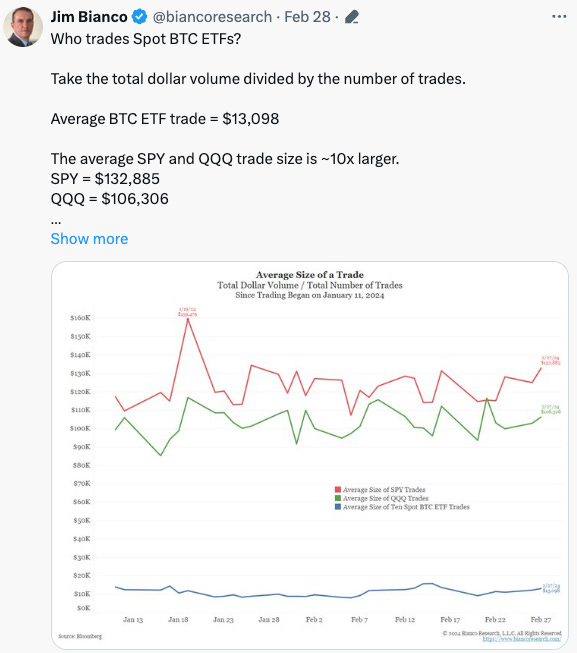

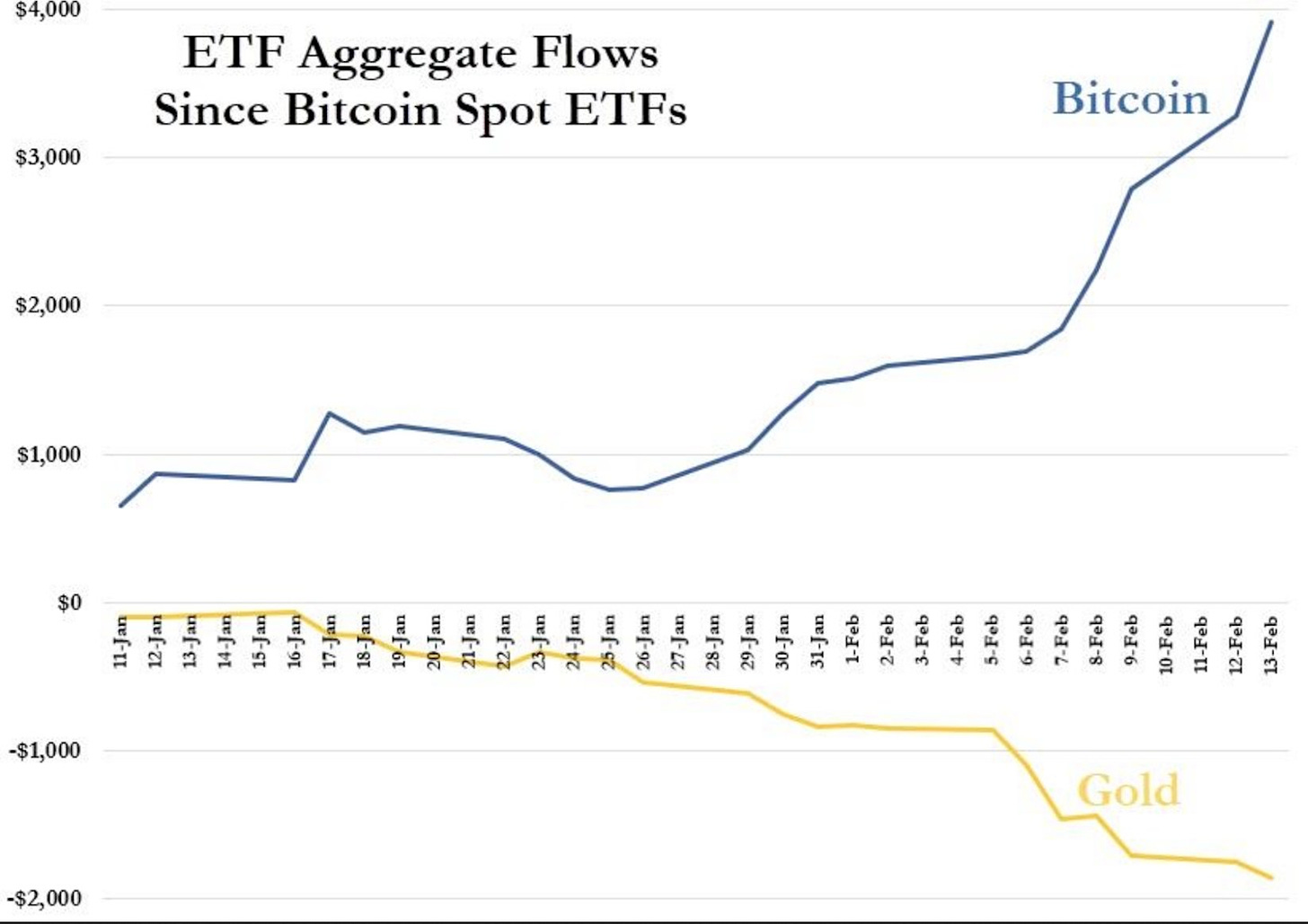

Spot Bitcoin ETFs have a ways to go to outweigh their gold counterparts. If bitcoin’s market cap was to reach gold’s, ~$13 Trillion, that would be a per bitcoin price of about $650,000. If flows are an early indication of a continued trend then that passing of the torch could happen in this decade. Look at the tweet from Jim Bianco below. Bitcoin is experiencing staggering inflows on relatively small trade sizes. That could be in part due to retail still being largely gated from buying the ETF. Vanguard, JPMorgan, Edward Jones, and more don’t allow retail clients to buy these products on their platforms. These brokerage houses are going to end up folding and eventually allowing their clients to invest in bitcoin ETFs because they don’t want to give up market share.

Vanguard’s CEO even stepped down recently, which may not be a coincidence. Regardless once they

reverse course, even more liquidity will be unlocked and we could see a parabolic move in bitcoin’s

marketcap.