Forecast

Nodeworthy

Adding It All Up

About the Business

DAIM’s Featured Portfolio

Forecast

November was the month that the FTX house of cards finally came tumbling down. The exchange became insolvent and recently entered chapter 11 bankruptcy. Retail investors, hedge funds, and market makers that did business with FTX or left assets on the exchange are hurting the most. Many others will be indirectly affected by a loss of trust in the system. We think the fallout is primarily contained to FTX and Genesis and that the worst is behind us. Should further reverberations from FTX or a completely new catalyst emerge, Bitcoin could be pressured through $13,000.

Alternatively CPI tailwinds could push all risk assets in the right direction, taking Bitcoin to the upper $24,000 range. Headline and core inflation eased last month, coming in below analyst estimates and giving hope that inflation has already peaked, and predictions are for smaller 50bps hikes in the next few meetings. Unemployment is still low and consumer spending is strong so if Fed Chairman Jerome Powell wants to reiterate his hawkish tone he certainly has data to back him up. Ultimately we think the knock-on effects from FTX will be small going forward and that the upside outweighs the downside.

Nodeworthy

Google recently introduced their Blockchain Node Engine that will allow Ethereum web3 enthusiasts to set up their own full node in a more streamlined manner. To try and put it simply, a full node has the entire history of a particular crypto’s activity and is needed for developers to build applications on top of blockchains.

We think a large player like Google getting on board and supporting the Ethereum network is a promising development for the entire crypto space. At some point there needs to be a clear use case for these projects and a demonstrative economic or social benefit. If it takes a large corporation jumpstarting that development then so be it. Sometimes the ends can justify the means.

Adding It All Up

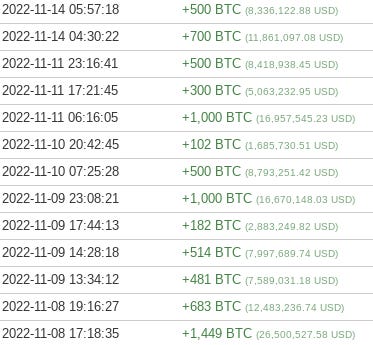

Back in July we took a quick look at the 3rd largest Bitcoin wallet. It was intriguing to see the trading behavior of one of the largest Bitcoin holders. So what has this person been up to over the last few months? When we went to analyze their activity we were surprised by a drastic change. Just 3 weeks after we wrote about this wallet, all the Bitcoins were moved out, but to where?

If this was the traditional finance world, we wouldn’t know, and our story would end there. Fortunately for us, these transactions take place on a transparent blockchain. On-chain analysis shows that the BTC was transferred to a Coinbase wallet. From there this particular whale could sell their large stack or simply transfer it to another wallet. To the benefit of HODLers this whale simply transferred the BTC to another wallet. You can see it here.

One important thing to note is that after the Bitcoins were transferred from Coinbase to this new wallet, the amount of Bitcoin it held grew! The wallet we first introduced topped out at 132,882.54 BTC. The current wallet holds 141,664.89 BTC. That means 8782 BTC were purchased in the last 4 months. In November alone more than 7900 bitcoin were purchased and transferred to this wallet. This represented a 6% increase in their stack and was done at a BTC price around $15,700-$18,200.

The fact that this person or entity increased their stack this month is probably the most important takeaway. Investing in a highly volatile asset can be difficult at times. But the fundamental principle of buying low and selling high proves successful no matter what the asset is. If the 3rd largest Bitcoin holder can recognize the opportunity and add units at this time, so can you.