- Forecast

- Here They Come

- Separate and Not Equal

- Inevitable Letdown?

- Noteworthy

- Summary Video

- Forecast - It’s deja vu all over again if you read last month’s post. We’re still in the accumulation zone for Bitcoin with the halving only 8 months away now. We are still on track for the halving and another sustained bull run. Last month the XRP ruling breathed some life into the crypto market. This month we have the Grayscale ruling that has investors feeling good about digital assets. That ruling specifically said that the SEC must review its rejection of Grayscale’s request to convert their GBTC trust shares into an ETF (Exchange Traded Fund). Many experts feel that this is clearing the path for an eventual Spot Bitcoin ETF. More on a possible ETF later. We still think it would take a black swan event to get Bitcoin below $20K. The macro landscape hasn’t changed and we are still in wait-and-see mode for a recession. We think the range for Bitcoin is $25K-$30K.

- Here They Come - We mentioned the Grayscale ruling in our forecast. We think that it is the tip of the proverbial iceberg for spot Bitcoin ETFs. The Purpose spot Bitcoin ETF has been trading in Canada since 2021. But for reasons known only to the SEC, the US does not have one, yet. One common speculation is that the SEC is trying to line up multiple applications to be approved at once. The thinking is that whichever application is the first to be approved will gain a disproportionate amount of AUM relative to subsequent ETFs. So in the interest of fairness, multiple will be approved and market participants can choose which one they would like to invest in. So what happens to digital asset investors when the ETFs arrive? In the short term, your holdings could see a nice bump in price due to ETF inflows which will require spot Bitcoin to be purchased. This increase in demand should lead to Bitcoin appreciating initially. After the hype dies down we don’t see the digital asset investing landscape changing dramatically.

- Separate and Not Equal - While an ETF provides a way for traditional investors to access Bitcoin in a familiar setting, ETF ownership will never provide the value that direct ownership does. First, there is a matter of cost. ETFs have management fees that they will pass on to investors. Even if the fund is just buying/selling one asset, Bitcoin, there are administrative, accounting, and other management functions that must be subsidized and passed on to investors. Secondly, there is tracking error. Tracking error is how closely the performance of an investment matches its benchmark. In our case, if Bitcoin is up 15% for the week we would expect the spot Bitcoin ETF to be up by the same percentage. But this probably won’t be the case. First, there are the management fees that we spoke about. The fees are paid out of the fund, reducing its value.Then there is the fact that Bitcoin trades 24/7 whereas publicly listed ETFs trade M-F from 9:30 am to 1:00 pm EST not including holidays. So if Bitcoin is up 15% for the week but it is after trading hours on Friday, you will have no recourse to realize that gain for your ETF holdings until the market opens back up on Monday. By that time the price will most likely be very different. Finally, you will lose the fundamental characteristics such as divisibility, and portability, to name a couple. You will only be able to buy whole shares, not whatever dollar amount you wish. It may not seem like a big deal but for small investors who want to DCA, direct purchase of Bitcoin will remain superior. In addition, moving your assets to another broker can be an onerous, time-consuming process. There may even be a fax machine involved. Owning an ETF may feel more familiar, but that is where the benefits stop. If you want access to Bitcoin, just buy Bitcoin.

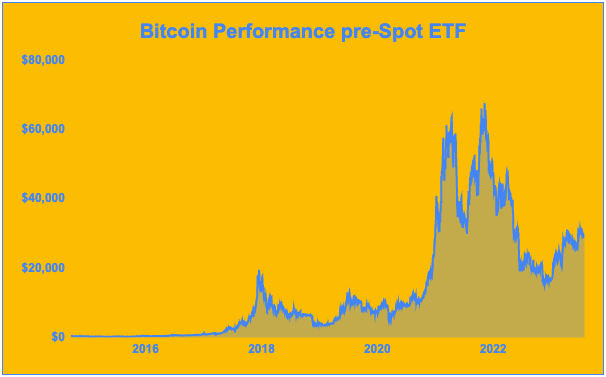

- Inevitable Letdown? - Many crypto-native investors are interested in a spot Bitcoin ETF because they think that the ETF inflows will make their personal holdings appreciate dramatically. But what if the approvals never come? If you’re counting on the SEC for clear, consistent, and sensible enforcement of securities regulations then you should probably stop counting. While we think multiple spot Bitcoin ETFs are on the horizon, the SEC could easily drag this on indefinitely in the interest of “investor protection”. If that's the case we will be just fine. Bitcoin has existed and thrived for more than a decade without a spot Bitcoin ETF and it will continue to do so. Its ethos of decentralized, self-sovereign, peer-to-peer digital currency never relied on TradFi adopting it. Other scarce assets such as fine art, wine, and exotic cars, don’t have financial instruments tracking their price and they have continued to maintain their market just fine. Look at Bitcoin’s historical performance below. With or without a spot Bitcoin ETF, the show will go on.

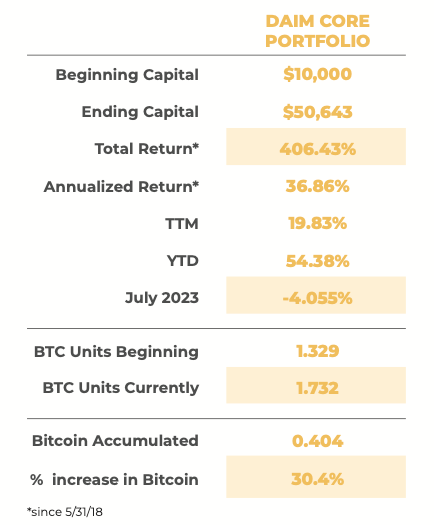

- Noteworthy - If you are a business owner, now is the time to review your 401k plan to ensure you are best serving your employees. We create unique plans that allow employees to invest directly in Bitcoin. More here: https://www.daim.io/crypto-401k/We helped our exotic car client sell another luxury SUV for cryptocurrency. About Marino Performance Motors HEREOur managed portfolio returns, through July, are below.