Planning Your Next Move - Congrats! You just bought some crypto a couple of weeks ago and the price doubled. Now what? Do you take profits or let it ride? In a space as volatile as crypto it isn’t hard to experience some exponential growth if you’ve been around for a while. But to enjoy long-term success you need to know when to take some profits. Selling at opportune times is just as important as buying in the first place. No one can call the exact top. But by using Bitcoin metrics and diligently sticking to a plan you may be able to capitalize on this bull run. Below are some on-chain metrics and other indicators you can incorporate into a well-developed strategy.

- Short-term vs long-term holders - Since Bitcoin is a new asset with a short history, metrics that relate to it tend to reflect that. So it’s not surprising that the delineation between a short and long-term holder is only 155 days. And yet history has shown that if Bitcoin does not move out of a wallet for 155 days, the likelihood of it moving any time soon decreases drastically. In general long-term holders tend to outnumber short-term holders during the bull part of a market cycle. The rationale is that the holding constricts supply and creates upward price pressure due to demand from newer short-term holders. As the peak of the cycle approaches, long-term holders will begin to take profits and the shift to the market being dominated by short-term holders will take over. Then accumulation restarts as short-term holders wait to become profitable once more, become long-term holders, and the cycle repeats.

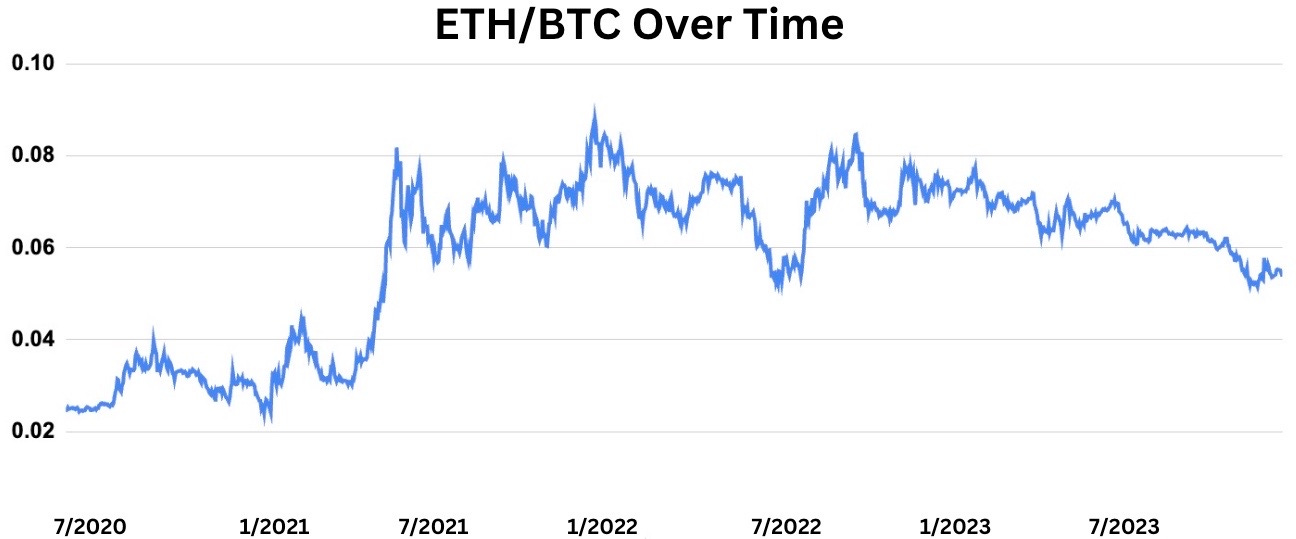

- BTC ratio - The Bitcoin ratio is a relative value comparison of a coin’s dollar value vs Bitcoin’s dollar value. There are a couple of benefits to looking at assets about Bitcoin. First, all cryptocurrencies will have begun trading after Bitcoin so you will get a good historical relationship that represents the altcoin’s entire trading history. Second, comparing an altcoin to Bitcoin will give you a better idea of the true performance of the coin. If Bitcoin is up 50% in US dollar terms and your coin is up 45%, then your token is in a sense underperforming and you should have just held Bitcoin. For a more in-depth understanding, let's look at the historical ETH/BTC ratio. The ratio for the most part has stayed in the .02-.1 ETH/BTC range for the history of Ethereum. It is currently at .054 ETH/BTC. Again nothing is scientific about this historical relationship but we think that ETH is a great buy below .05 ETH/BTC and a great sell at about .08 ETH/BTC. When trading this pair you don’t need cash, you can simply swap from one to the other when your desired level is hit.

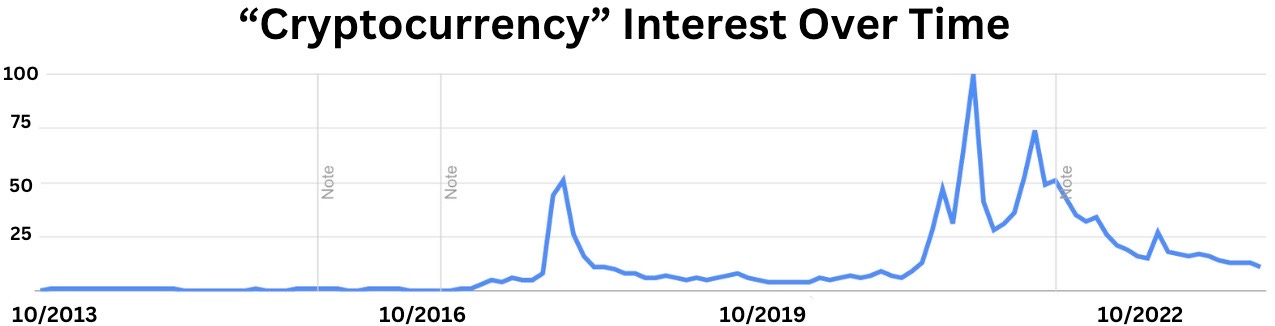

- Google Trends - This may seem obvious but knowing who is googling what can help us determine the general level of demand and, to an extent, future price movement. If you look below you will see peak “Cryptocurrency” interest on Google preceded strong declines in the price of digital assets. The January 2018 peak was right when the fun from the 2017 bull run ended. In May 2021 the peak was followed shortly by China banning mining and a precipitous market decline followed in June. And in November 2021 the Bitcoin all-time high was reached, followed by a steep increase in interest rates that wrecked all risk assets. 2023 has been a strong bull bull year for crypto but we have yet to see the commensurate uptick in Google searches. Does that mean we have room to run? Time will tell.

- Wallets in Profit - We’ve covered this one before. The metric is pretty straightforward. It compares the price when Bitcoin was transferred into a wallet to the current price of Bitcoin. If the current price exceeds the price when the BTC was transferred then that wallet address is in profit. During bull runs this metric can stay above 90% for an extended period. But once it gets above 99% a reversal is likely to happen in relatively short order. It makes sense that if almost all holders have profited there will be many who want to take profits. Right now we are around 80% so there is room for continued price appreciation given historical precedence.

- Pi cycle top chart. It seems like every cycle there is a model de jour that can predict the price of Bitcoin. Last cycle it was Plan B’s Stock to Flow (S2F) Model. While S2F has been invalidated for the past couple of years, it is still fun to look at these charts and imagine what the future holds. One chart to look at is the Pi Cycle Top Indicator. The idea is that after the 111-day MA (moving average or average of the price of an asset for that time period) crosses the 350-day MA x2 on an upward trend, a Bitcoin top is hit. It will be interesting to see if this relationship holds but we would be wary of a model that seems to overfit data points to inform some sort of relationship. The 350-day moving average is multiplied by 2 for a seemingly arbitrary reason and 111 days is also a convenient choice. If you divide 350/111 you get 3.15 which is close to Pi rounded to two decimals. Put this all together and you get a metric that is easy to track and has coincidentally called past market tops. It’s fun to follow but don’t put too much faith into its predictive power.

Remember that these are all just guides and that historical relationships don’t necessarily have to hold in the future. The most important thing is to develop a strategy and be disciplined in sticking with it. If you want to follow the Pi indicator, Google trends, wallets in profit, or any other metric, create an initial plan and stick to it as best you can. Your thesis can change, but if the changes are constant, especially with a volatile asset like crypto, you will most likely lose value over time and impair units of the tokens you hold.