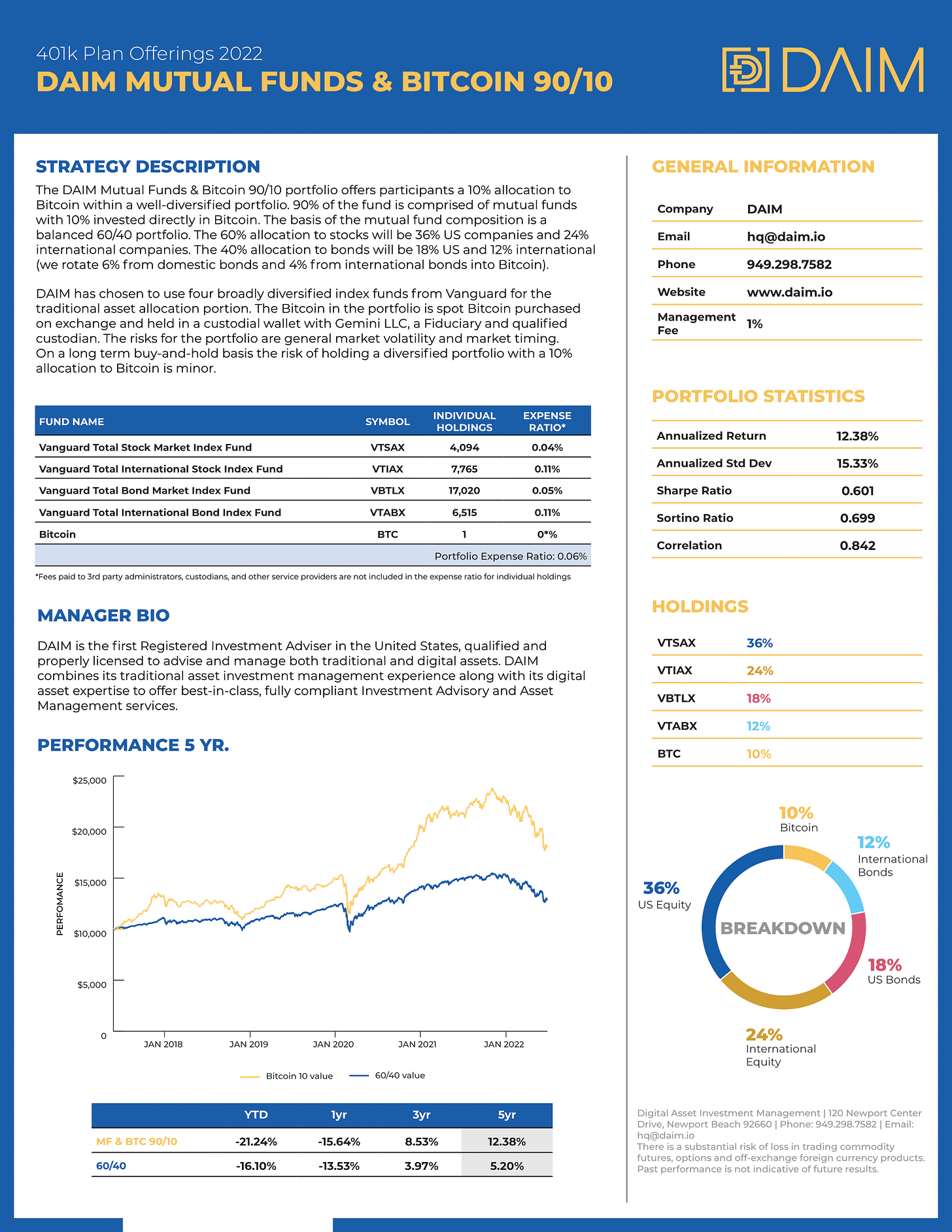

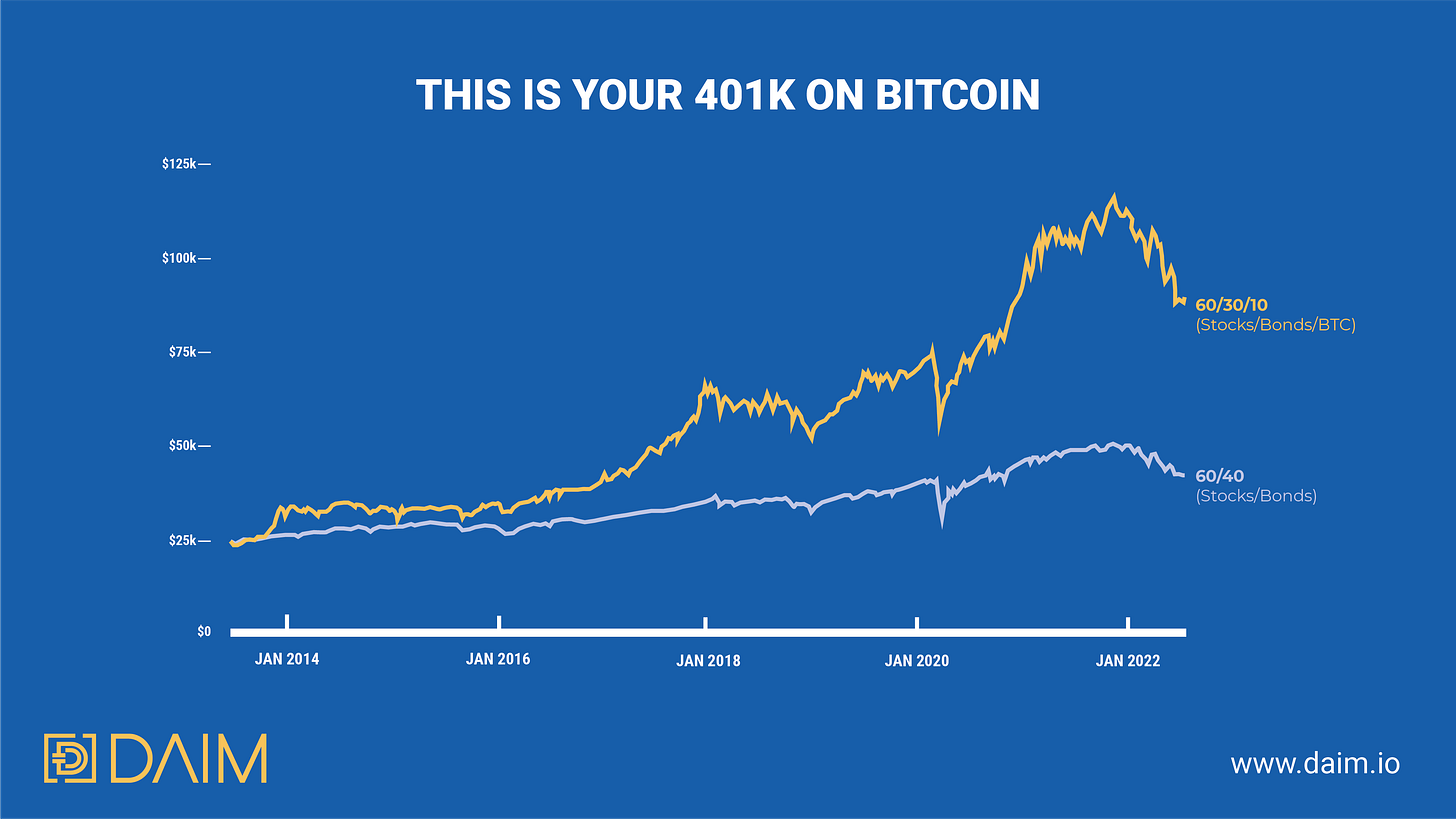

Employers now have the ability to offer 401K plans with direct exposure to Bitcoin through DAIM. We have been offering participants the ability to hold Bitcoin in their 401K since last year and are looking to help more businesses help their employees prepare for retirement. Our investment options are based on a traditional 60/40 (stock/bond) portfolio with an added exposure of spot Bitcoin (up to 10% of the overall allocation).

Adding a reasonable allocation (≤10%) of Bitcoin to any well diversified portfolio has shown improved portfolio performance, on an absolute and risk-adjusted basis, over a long time horizon. Given where we are in the Bitcoin cycle, forward returns for the next 5 years will help provide an immense benefit to the value of a plan participant's portfolio. We feel the volatility of Bitcoin can be a positive thing, the longer your time horizon is the more beneficial it will be to have exposure to it. This product is especially enticing for employers with a relatively young workforce as there is a distinct possibility the adoption of Bitcoin increases exponentially over the next 20-30 years.

The strategy was built using low cost index funds from Vanguard and spot Bitcoin, bought on exchange through Gemini. It is an efficient, low cost way to set up employees for retirement. We are well equipped to handle the murky regulatory environment ERISA plans are currently facing. We’ve been in business for a long time in this industry and every time we have been audited, regulators have affirmed what we are doing is suitable for the participants we serve. While the future may seem uncertain, getting exposure to Bitcoin now will help set up employees to retire comfortably when the time comes. You can view the fact sheet for one of our funds below. If you would like more info click the contact us button or call 949.298.7582