- Forecast

- Transaction fees

- Liquid staking

- Webinar

- Forecast - Many say that index investing will face challenges in the coming years, while elevated rates are expected to dampen the performance of risk assets. Both of these assertions may prove to be true. However, we have observed that certain assets, such as Bitcoin and AI stocks, have performed well throughout this year. Although the momentum of ballooning AI stocks may slow down in the near future, we remain optimistic about Bitcoin's prospects as the only liquid fixed-supply asset, which continues to thrive in a bull market. In the short term, we anticipate a price range of $22,500 to $30,000 until the occurrence of the next positive catalyst that can drive prices upwards.

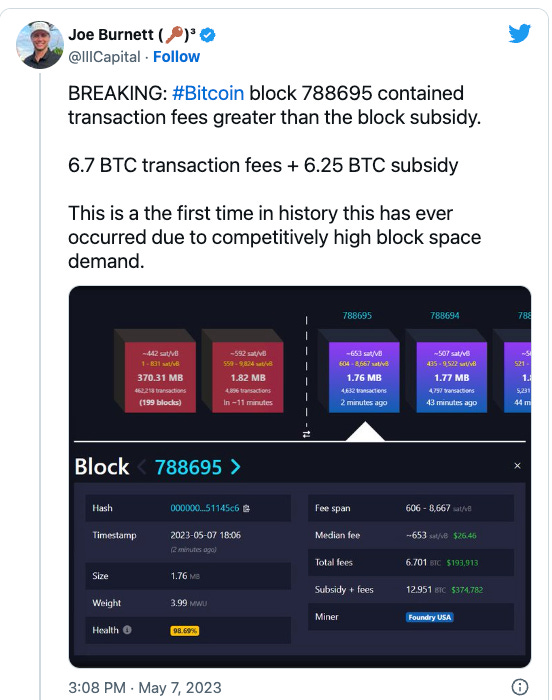

- Transaction fees - Nothing lasts forever, and that goes for the Bitcoin block reward. Many have wondered what the lack of a block reward would mean for miners and subsequently the security of the network. The block reward is necessary to incentivize miners to participate in the network. The more miners participating, the higher the hash rate, and the higher the hash rate, the more secure the network. We may be getting a glimpse of what the future looks like. Inscriptions, made possible by the Ordinal protocol, have experienced a significant surge in recent weeks. Before May, there had been about 2.5 million inscriptions. In just the first week of May, there were another 2.4 million. That same week there was a block that netted 6.7BTC in transaction fees. This of course eclipsed the current block reward of 6.25BTC. As we write this, at the end of May, the number of inscriptions is over 10 million.

Transaction fees are a necessary evil, they help subsidize the network to make sure it runs smoothly. If the network can generate fees that will encourage miners to participate without needing a block reward then Bitcoin can continue to grow and evolve in a meaningful way.

- Liquid staking - Gemini recently enabled liquid staking after the Shanghai upgrade was completed. When Ether is staked, investors get rewarded with a yield paid in units of ETH. We are currently conducting due diligence on the staking functionality for clients and are looking to implement it for all ETH holdings. If we are satisfied with our test results we project rolling out the feature sometime in June. Stay tuned.

- Webinar - Bryan will be a guest on an upcoming webinar hosted by Precision Planning. They will go over investing in crypto within a traditional portfolio and some specific tax strategies. You don’t want to miss it. Sign up here.